NEW POINTS ON INVESTMENT OF STATE CAPITAL IN ENTERPRISE AND MANAGEMENT AND USE OF CAPITAL AND CORPORATE ASSETS

NEW POINTS ON INVESTMENT OF STATE CAPITAL IN ENTERPRISE AND

MANAGEMENT AND USE OF CAPITAL AND CORPORATE ASSETS

In line with the operation and development of the Vietnamese economy, constantly improving the efficiency of capital use will be a necessary measure to ensure the financial safety of enterprises in general and enterprises. state-owned enterprises in particular. As a result, businesses will manage and reduce risks associated with daily operations, support market competition, and foster favorable conditions for the implementation of projects. Within the context of this article, Dai Ha Thanh Law Firm will present information on general regulations on state capital investment in businesses and management and use of state capital in corporate assets, while also making reference to recent regulations on this subject.

1. Overview of state capital investment in enterprises and management and use of capital and assets of enterprises

1.1 The concept of enterprises and enterprises with state capital

An enterprise is defined as an entity having its own name, property, transaction office, founded or registered for establishment under the provisions of law for business objectives, according to Clause 10, Article 4 of the Enterprise Law 2020. Which state-owned businesses are included:

A company is considered a state-owned enterprise if the State owns a stake and contributes between 0% and 50% of the charter capital as a shareholder. For other businesses and people, the State may be the sole or joint owner. The state's rights and obligations towards firms will vary depending on the amount of capital the state contributes and the proportion of charter capital.

According to Article 88 of the Law on Enterprises 2020, state-owned businesses are those in which the government owns more than half of the voting stock and charter capital.

There are many different types of state-owned businesses, including joint-stock corporations, limited liability companies with two members or more, and limited liability companies with just one member.

1.2 Overview of State capital investment in enterprises

Investment of State capital in an enterprise is the use of capital by the State from the State budget or capital from funds managed by the State to invest in an enterprise.

State capital in enterprises includes capital from the State budget, capital received from the State budget; capital from the investment and development fund at the enterprise, the enterprise arrangement support fund; credit capital guaranteed by the Government, development investment credit capital of the State and other capital invested by the State in enterprises.

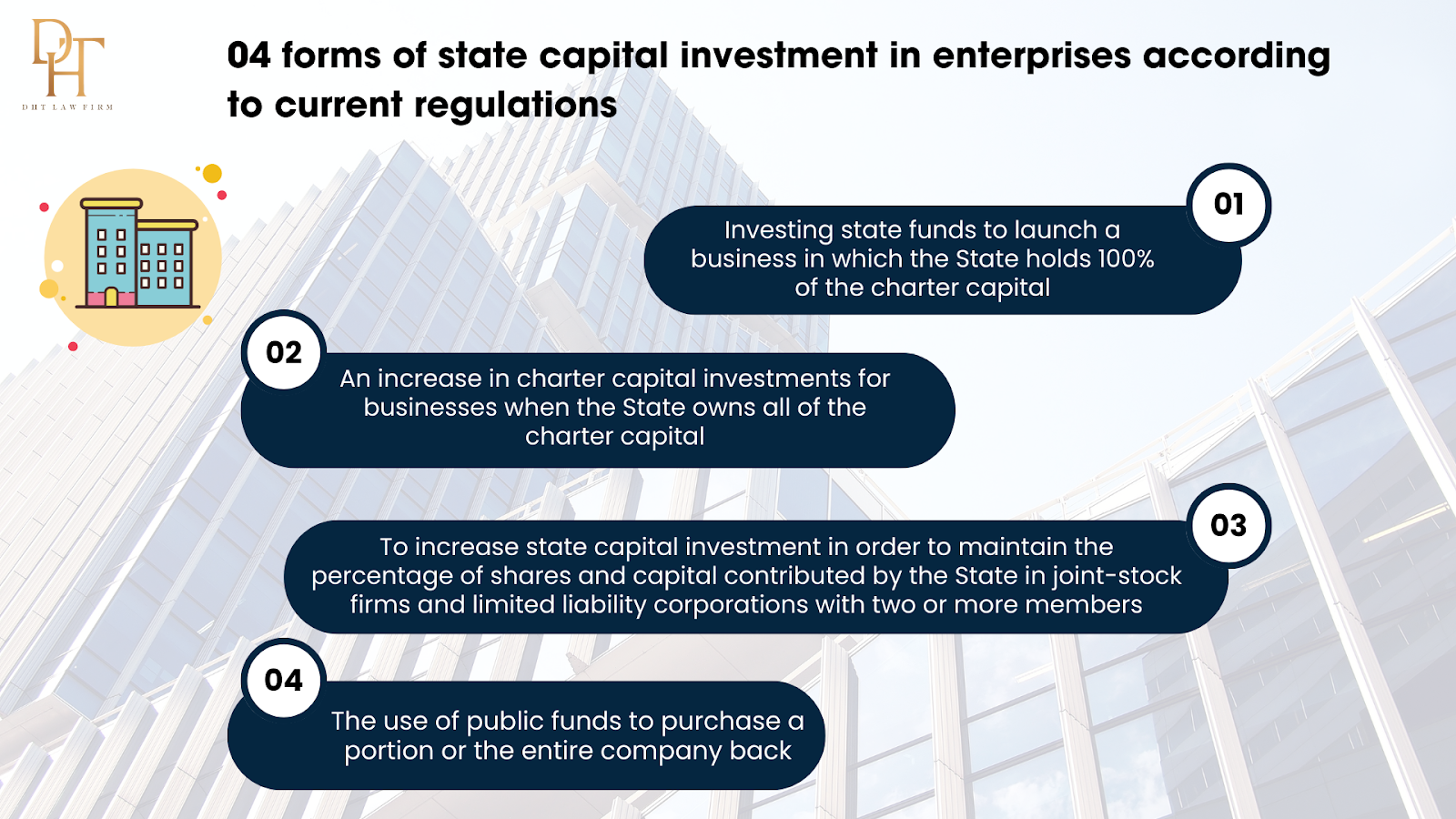

1.3 Forms of state capital investment in enterprises

According to current regulations, there are 04 forms of state capital investment in enterprises as follows:

- Investing state funds to launch a business in which the State holds 100% of the charter capital.

- An increase in charter capital investments for businesses when the State owns all of the charter capital.

- To increase state capital investment in order to maintain the percentage of shares and capital contributed by the State in joint-stock firms and limited liability corporations with two or more members.

- The use of public funds to purchase a portion or the entire company back.

1.4 Regarding the management and use of capital and assets in the enterprise

Currently, there is no legal definition of assets as they relate to the idea of assets in businesses. There are numerous ways to categorize assets based on various factors, including their origin, mode of manifestation, duration of use, nature, and characteristics. Assets can be divided into the following categories: short-term and long-term, tangible and intangible, fixed, liquid, and circulating. which classifies assets into short-term and long-term categories is the most popular.

Current assets are assets with low value and short usable lives (less than a year or one typical business cycle), and they frequently vary in value as a result of daily operations. use. In businesses, short-term assets include cash and cash equivalents (values of securities with maturities within three months, gold, silver, gems, and metals); short-term financial investments; inventory; or other short-term assets like deposits, short-term deposits, advances, and short-term prepaid expenses.

Long-term assets are those of an entity that have a long useful life, turnover and recovery period (more than 12 months or over many business cycles) and rarely change in value over the course of the business. Long-term investments, copyrights, patents, trademarks, computer software, mining and licensing licenses, corporate trademarks, fixed assets like buildings, structures, devices, transmission methods of transportation, specialized equipment for management, perennials, working animals, and products are all examples of long-term assets. The term "investment real estate" refers to properties such as homes, land that has been purchased for financial gain, or other long-term assets such long-term prepayment costs, construction in progress investment costs, and deposits for long-term escrow.

An enterprise's assets play a significant role in how the organization operates overall. Since corporate assets are owned by the company, they must be carefully preserved and stored. As a result, managing corporate assets is a crucial task that any company must complete.

The allocation and reserve of the owner of the enterprise's capital, the enterprise's assets, as well as loan and investment capital, are all handled by the competent authority in the enterprise. External funding is required for the enterprise's business and production activities.

Investments of State Capital in Enterprises, as well as the management and use of Enterprise Capital and Assets, Must Adhere to Specific Principles Specified in Article 5 of the Law on Management and Use of State Capital Invested in Production, Doing Business at the Enterprise in 2014 as Amended in 2018, Including the Following Principles:

- Comply with the law on investment, management and use of state capital in enterprises.

- Comply with the socioeconomic development strategy and plan, as well as the master plan for sector development

- Investing state capital to form and maintain enterprises at key stages and stages in a number of industries and fields in which other economic sectors do not participate or are subject to the State holding 100% of charter capital , maintain the ratio of shares and contributed capital as prescribed in Articles 10 and 16 of this Law.

- The owner's representative agency, the state management agency, shall not directly intervene in the enterprise's production and business activities, as well as the enterprise manager's management and administration activities.

- Management of state capital invested in enterprises must be through the direct owner's representative or the representative of the state capital portion; ensure that enterprises do business and production according to the market mechanism, equality, equality, cooperation and competition according to the law

- The owner's representative agency, the direct owner's representative, and the representative of the state capital share are responsible for the management and use of state capital in the enterprise, ensuring efficiency, preserving and increasing the value of the state capital. value of state capital invested in enterprises; prevent and combat the spread, waste and loss of capital and assets of the State and enterprises.

- Publicity and transparency in investment, management and use of state capital in enterprises.

- Conform to international treaties to which the Socialist Republic of Vietnam is a signatory.

2. New regulations on investment of state capital in enterprises and management and use of capital and assets of enterprises

To strictly ensure the safety of corporate finance in general, and state-owned enterprises in particular, thus reinforcing the existence and development of enterprises, State capital investment in enterprises, as well as management and use of capital and corporate assets, must be improved effectively. On March 17, 2023, the Minister of Finance published Circular 16/2023/TT-BTC, which became effective on May 8, 2023, modifying Circular 36/2021/TT-BTC and guiding the internal content on State capital investment in companies, as well as management and use of capital and assets in enterprises. As a result, Circular 16/2023/TT-BTC establishes profit distribution restrictions for joint stock firms and limited liability companies with two or more members owning State shares or contributed money, specifically:

- Enterprises distribute profits according to the provisions of Clause 17, Article 2 of Decree 140/2020/ND-CP dated November 30, 2020.

For example, if the State owns more than 50% of the charter capital or the total number of voting shares in a company with shares or contributed capital, the dividend distribution plan and yearly profit after tax shall be distributed in the following order:

+ Divide profits to the associated capital contributors (if any);

+ Offsetting the loss of previous years, the time limit has expired to be deducted from profit before tax;

+ A maximum deduction of 30% into the enterprise development investment fund (if the enterprise's organization and operation charter stipulates the setting up of this fund);

+ Deducting bonus funds, welfare funds for enterprise employees, and bonus funds for enterprise managers in accordance with regulations;

+ Profits will be dispersed to shareholders and capital contributors who have contributed. In terms of dividends and profits distributed in cash to state capital invested in firms, they must be remitted to the state budget in accordance with legislation.

(2) If the firm follows the parent company-subsidiary company model, the after-tax profit is determined using the parent company's separate financial statements as the basis for distribution.

The article above by Dai Ha Thanh Law Firm provides information on general regulations on state capital investment in firms, as well as management and use of state capital in enterprise assets. If you have any questions or concerns, please contact us for competent legal counsel.