NOTES FOR FOREIGNERS WHEN INVESTMENT BUY APARTMENT IN VIETNAM

Investing in buying apartments in Vietnam is always a matter of special interest to foreign investors when investing. Apartments are one of the types of housing. Besides domestic households and individuals, foreigners are one of the subjects who are allowed to own houses in Vietnam. So, what should foreigners who want to invest in buying apartments in Vietnam pay attention to?

1. Foreigners are allowed to own houses in Vietnam

Pursuant to Clause 1, Article 159 of the Law on Housing 2014, foreign organizations and individuals entitled to own houses in Vietnam include:

- Foreign organizations and individuals investing in housing construction under projects in Vietnam in accordance with the provisions of the Law on Housing 2014 and relevant laws.

- Foreign-invested enterprises, branches, representative offices of foreign enterprises, foreign investment funds and foreign bank branches operating in Vietnam (collectively referred to as foreign organizations).

- Foreign individuals are allowed to enter Vietnam.

2. Area where foreigners are allowed to own houses in Vietnam

According to Clause 1, Article 75 of Decree 99/2015/ND-CP, foreign organizations and individuals are only allowed to own houses (including apartments and separate houses) in investment projects on housing construction. commerce, except for areas where national defense and security are ensured in accordance with Vietnamese law. In other words, foreigners can still buy houses in Vietnam but are limited in geographical area.

At the same time, the area to ensure national defense and security in each locality will be determined by the Ministry of National Defense and the Ministry of Public Security and notified in writing to the People’s Committee of the province or centrally run city to serve as a basis for directing the Department of Public Security. Formulate a specific list of commercial housing construction investment projects in the locality that allows foreign organizations and Individuals to own houses.

3. Form of ownership and number of houses that foreigners can own

Regarding the form of ownership, foreign organizations and individuals are allowed to own houses in Vietnam through the following forms: Investment in housing construction under projects in Vietnam in accordance with the Law on Housing 2014. and relevant laws; Purchase, lease-purchase, donation or inheritance of commercial housing, including apartments and separate houses in housing construction investment projects, except for areas ensuring national defense and security as prescribed.

In addition to regulations on the area and form of foreigners being allowed to own houses in Vietnam, the housing law also clearly stipulates the number of houses that can be owned. This is clearly defined as follows:

Based on the notices of the Ministry of National Defense and the Ministry of Public Security and the direction of the People's Committees of provinces and centrally run cities according to regulations, the Department of Construction is responsible for publicly announcing it on the website of the Department of Internal Affairs. stand behind:

+ List of housing construction investment projects in the area located in the area where foreign organizations and individuals are allowed to own houses.

+ Number of houses (including apartments and separate houses) that foreign organizations and individuals are allowed to own in each housing construction investment project that are permitted to own; number of apartment buildings in each apartment building, number of individual houses of each project that foreign organizations and individuals may own.

+ Number of houses that foreign organizations and individuals have purchased, rented-purchased, and have been granted certificates of in each housing construction investment project.

+ Number of apartment buildings that a foreign organization or individual may own in case there are many apartment buildings in an area with a population equivalent to a ward-level administrative unit; the number of separate houses that a foreign organization or individual is entitled to own in case an area with a population equal to a ward-level administrative unit has one or more projects but has a total number of houses. individual units less than or equivalent to 2,500 units.

In addition, foreign organizations and individuals eligible to own houses in Vietnam may only buy, lease-purchase houses from investors in housing construction projects or purchase houses from foreign organizations and individuals. specified at Point b, Clause 4, Article 7 of Decree 99/2015/ND-CP and may only inherit, receive as a gift for houses of households or individuals, or receive as gifts for houses of organizations in the number of houses. to live in accordance with the provisions of investment projects on construction of houses that are allowed to be owned; In case a foreign organization or individual is gifted or inherited a house in Vietnam but is not eligible to own a house in Vietnam, the Certificate of housing shall not be issued, but only sold or donated. for this housing for the subjects who own houses in Vietnam.

However, it should be noted that foreign organizations and individuals may only own no more than 30% of the total number of apartments in an apartment building; In case there are many apartment buildings for sale or lease purchase in an area with a population equivalent to a ward-level administrative unit, foreign organizations and individuals may only own no more than 30% of the apartments. of each apartment building and not more than 30% of the total number of apartments of all these apartment buildings.

If in an area with a population equivalent to a ward-level administrative unit, there is an investment project on the construction of commercial housing, including separate houses for sale or lease-purchase, the organization or individual Foreigners are allowed to own the number of separate houses according to the following regulations:

+ If there is only one project with less than 2,500 individual houses, foreign organizations and individuals may only own no more than 10% of the total number of houses in that project.

+ In case there is only one project with the number of separate houses equivalent to 2,500 units, foreign organizations and individuals may only own no more than 250 apartments.

+ If there are two or more projects and the total number of separate houses in these projects is less than or equal to 2,500 units, foreign organizations and individuals may only own no more than 10% of the number of houses in each project judgment.

4. Conditions for foreigners to buy houses in Vietnam

4.1. Prepare necessary documents for eligibility to own a home in Vietnam

For foreign individuals, they only need to be allowed to enter Vietnam and not be entitled to diplomatic and consular privileges and immunities according to the provisions of law (with entry visa + self-signed copy). commitment not subject to diplomatic and consular immunity).

4.2. Determining the type of house and land to be owned

Foreigners are allowed to own the following types of houses: commercial houses (including apartments and separate houses in housing construction investment projects. That means foreign individuals and organizations. Not allowed to buy townhouses, houses outside the project and not to receive the transfer of land use rights.

In which, commercial housing is a house invested and built for sale, lease, or lease-purchase according to the market mechanism. An apartment is a house with 2 floors or more, with many apartments, with common walkways and stairs, with private ownership, shared ownership and a system of infrastructure works for common use by households. families, individuals and organizations, including condominiums built for residential purposes and condominiums built with mixed-use purposes for residential and business purposes.

Specifically, in the case of buying an apartment, the Law on Housing 2014 prohibits the use of apartment buildings for non-residential purposes. As for the case of buying a separate house in a housing construction investment project, in this case, the housing law does not forbid you to use it for non-residential purposes.

In addition, foreign individuals and organizations must not own more than 30% of the number of apartments in an apartment building; if it is a separate house, including villas and adjacent houses, in an area with a population equivalent to a ward-level administrative unit, only buy, rent-purchase, receive as a gift, inherit and own no more than 250 (two hundred and fifty) houses. Regarding the ownership term, for individuals, it is not more than 50 years with the right to extend it, for foreign organizations, it is not more than the time limit stated on the investment registration certificate. As for the purpose of use, real estate owned by foreign individuals can be sub-lease, purchase, inheritance or mortgage.

4.3. Check real estate documents

For apartments and houses in the project that you want to buy, the State Government needs to ask the investor to provide the following documents:

• Certificate of business registration, real estate business lines

• Investment license, written approval of investment policy

• Certificate of land use right (Red Book) of the whole project area

• Documents related to the fulfillment of tax obligations and financial obligations of the investor

• Building permits and other permits related to construction

• Project dossier, construction drawing design approved by competent authorities

If it is a house to be formed in the future, it needs documents such as: Minutes of acceptance of completed foundations, guarantee contract, written permission to sell, lease-purchase from a competent state agency for the project. with the sale, lease-purchase of houses formed in the future.

4.4. Transaction Process

In order to avoid unnecessary risks, when investing in buying apartments in Vietnam, the State needs to understand the following transaction process:

- Customers choose the desired Apartment or commercial house and make a goodwill deposit through the Agent to register to buy (the goodwill deposit will be agreed later);

- The agent transfers the Client's deposit and registration to the Investor (detailed deadline is later);

- The Investor signs a deposit agreement with the Customer after receiving the goodwill deposit (specific deposit according to the sales policy);

- Customers pay the deposit according to the sales policy.

- The Investor will send a notice inviting the Customer to sign the Purchase and Sale Contract according to the term committed in the Deposit Agreement and documents related to the sale of the house (as with domestic customers) in accordance with regulations.

- Customers pay money according to the schedule specified in the Sale Contract to the Investor's account opened in Vietnam. Payment currency is VND.

- Upon completion of construction, the Investor sends a notice of handover of the Apartment or commercial house according to the schedule to the customer at least 30 days in advance; Customers receive and hand over the Apartment or commercial house according to the provisions of the Sale Contract (after having paid in full according to the Sale Contract);

- The Investor makes a certificate of ownership of the Apartment or commercial house for the Client

Note: NNN’s identification documents include:

(1) Passport is consular legalized in Vietnam;

(2) Visa to enter Vietnam is still valid (need to ensure that the time of signing the sale contract must be within the validity period of the visa) (or visa exemption certificate (foreigners whose spouses, children are Vietnamese or Vietnamese people residing abroad).

5. Legal issues and procedures in the process of selling houses to foreigners in Vietnam.

5.1. Procedures for transferring money for housing payment

Foreigners who are eligible to buy an apartment in Vietnam can transfer money to buy a house in the following forms:

• Open a bank account in Vietnam to use the transfer account for the seller;

• Transfer money directly to the seller's account, note the need for the code of the bank where the seller has an account;

• Transfer cash via bank to the seller.

The payment for house purchase under the direction of the Government, the State Bank will provide specific instructions on the payment of house purchase and sale money through credit institutions of foreigners when buying houses in Vietnam.

5.2. Taxes, fees and charges for foreigners owning apartments in Vietnam

5.2.1. Registration fee

Homebuyers and developers can also agree on who pays this fee. The registration fee for houses as prescribed in Clause 1, Article 7 of Decree 140/2016/ND-CP is 0.5% multiplied by the property value.

5.2.2. Fees for issuance of certificates of land use rights, ownership of houses and properties on land

According to the provisions of Clause 5, Article 3 of Circular 85/2019/TT-BTC, this fee will be prescribed by the People's Councils of the provinces and centrally-run cities. As such, this fee depends on the province, which will be applied at the rate set by the People's Council of that province or centrally run city.

5.2.3. Notarization fee for apartment sale and purchase contract

- Specific provisions in Section a7, Point a, Clause 2, Article 4 of Circular 257/2016/TT-BTC

- Particularly for the case of buying an apartment by the auction method, the notarization fee will be specified in Article 1 of Circular 111/2017/TT-BTC.

5.2.4. personal income tax

The seller and transferor must pay personal income tax at the rate of 2% calculated on the contract value, the value of the property or as agreed. Except for the case exempted under Clause 1, Article 3 of Circular 111/2013/TT-BTC.

5.3. Procedures for issuance of certificates of apartment ownership.

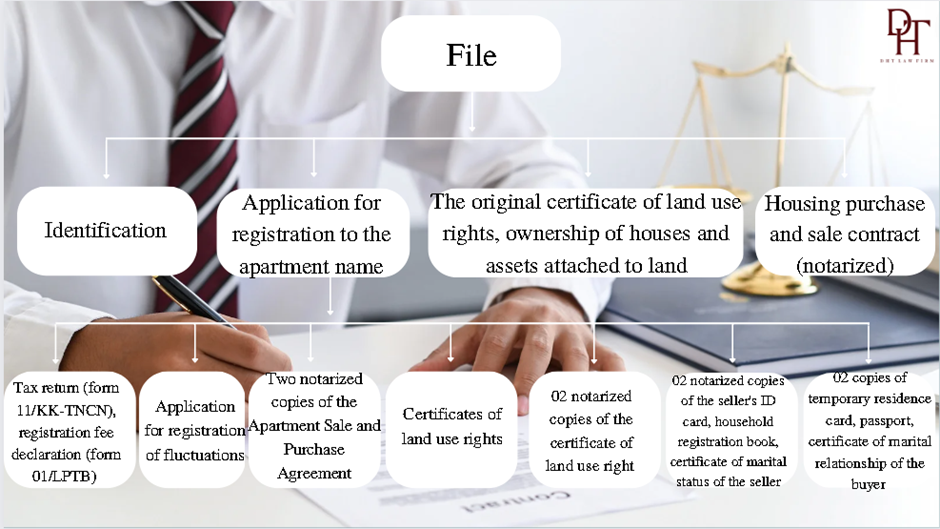

5.3.1. File

• Identity documents (ID/CCCD, household registration book, passport, marriage certificate, temporary residence card of the parties)

• Housing purchase and sale contract (notarized)

• The original certificate of land use rights, ownership of houses and assets attached to land

• The application file for registration of the apartment name transfer includes:

- Non-agricultural tax declaration, personal income tax declaration (form No. 11/KK-TNCN), registration fee declaration (form 01/LPTB)

- Application for registration of volatility (signed by the seller/or agreed upon by the seller)

- Two notarized copies of Apartment Sale Contract

- Certificate of land use right (original)

- 02 notarized copies of the certificate of land use right

- 02 notarized copies of the seller's ID card, household registration book, certificate of marital status of the seller

- 02 copies of temporary residence card, passport, certificate of marital relationship of the buyer

5.3.2. Procedure

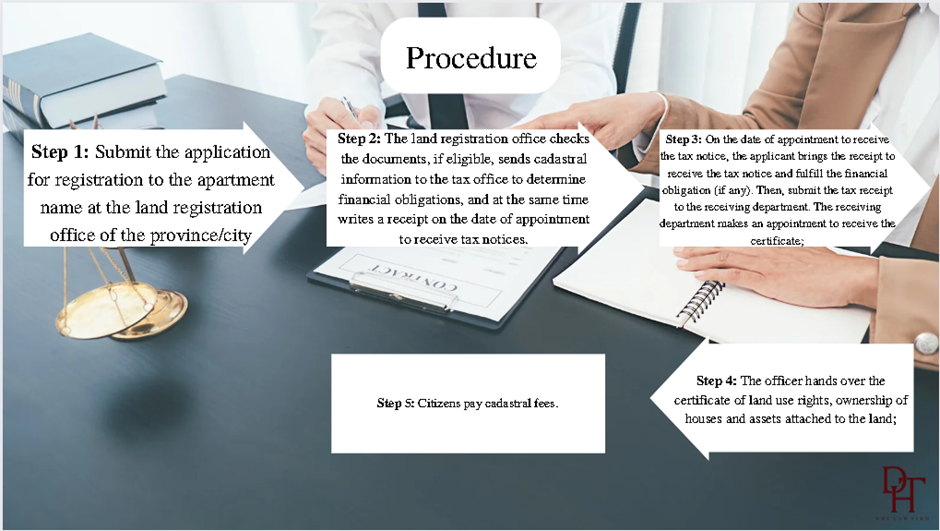

Step 1: Submit the application for registration to the apartment name at the land registration office of the province/city;

Step 2: The land registration office checks the dossier, if it is eligible, sends cadastral information to the tax office to determine financial obligations, and at the same time writes a receipt on the date of appointment to receive the tax notice;

Step 3: On the date of appointment to receive the tax notice, the applicant brings the receipt to receive the tax notice and fulfill the financial obligation (if any). Then, submit the tax receipt to the receiving department. The receiving department makes an appointment to receive the certificate;

Step 4: The officer hands over the certificate of land use rights, ownership of houses and assets attached to the land;

Step 5: Citizens pay cadastral fees.

Above is the entire content of DHT's advice on the notes when foreigners want to invest in buying apartments in Vietnam. Please contact us if you have any questions or concerns in this regard.