NOTES FOR FOREIGN INVESTORS WHEN INVESTING THROUGH JOINT VENTURES BETWEEN VIETNAMESE AND FOREIGN INVESTORS

1. Form of joint venture investment

1.1. What is a joint venture?

Currently, the Law on Enterprise 2020 and related guiding documents do not provide specific provisions on the concept of joint venture investment. However, in practice, the term joint venture can be understood as a form of economic cooperation that involves voluntary capital contribution by participating parties to establish companies or enterprises for joint production, management, and profit sharing based on an agreed method. The joint venture can take the form of cooperation such as between two or more participating enterprises of different nationalities, between a joint venture enterprise with a domestic enterprise or a foreign enterprise or with a foreign investor, and between joint venture enterprises, between governments of different countries.

A joint venture enterprise is an enterprise established in Vietnam by two or more parties cooperating based on a joint venture contract or an agreement signed between the Government of the Socialist Republic of Vietnam and the Government, cooperation by an enterprise with investment capital with a Vietnamese enterprise or by a joint venture enterprise with a foreign investor based on a joint venture contract. A joint venture enterprise is established in the form of a limited liability company. Each joint venture party is responsible for the extent of the committed capital contribution to the legal capital of the enterprise. A joint venture enterprise has legal status under Vietnamese law and is established and operated from the date of issuance of an Investment Registration Certificate.

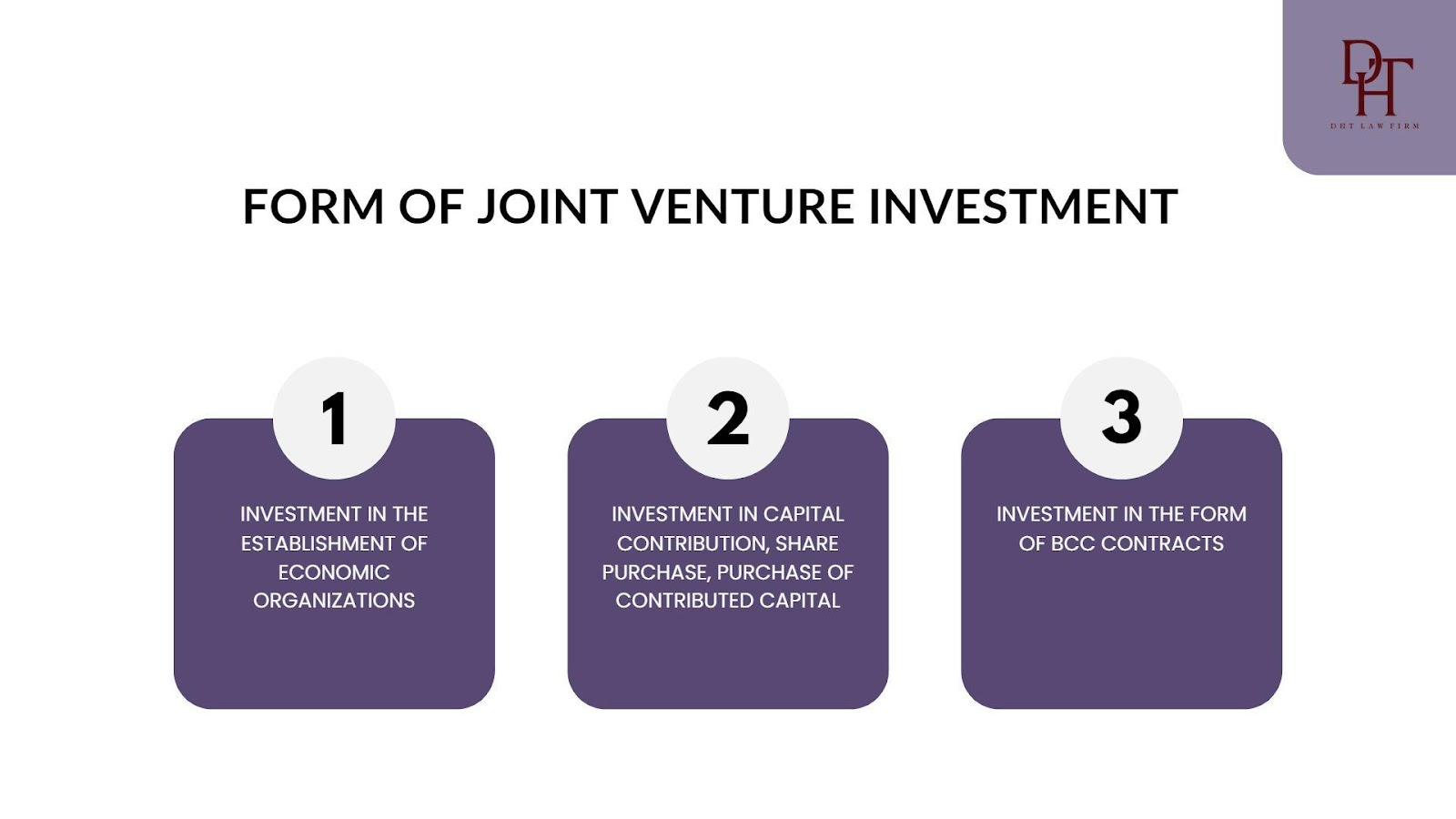

1.2. Form of joint venture investment

Article 21 of Law on Investment 2020 stipulates the form of investment for foreign investors as follows:

- Invest in the establishment of business organizations

- Investment in the form of capital contribution or purchase of shares or stakes.

- Execution of an investment project.

- Investment in the form of a business cooperation contract.

- New forms of investment and types of business organizations prescribed by the Government's regulations.

Thus, in addition to direct investment in the form of establishing business organizations with 100% foreign capital, foreign investors can also invest indirectly through joint ventures with partners in the country. and abroad such as investment in the form of a business cooperation contract (hereinafter referred to as BCC contract) and investment in capital contribution, share purchase and purchase of contributed capital.

However, in certain industries, investors are only allowed to invest in certain forms.

Example: For video game business services, only investment in the form of a business cooperation contract or joint venture with a Vietnamese partner is allowed to provide this service.

1.2.1. Invest in the establishment of an economic organization

The form of investment in establishing an economic organization is using the capital of an investor to conduct the establishment of an enterprise, cooperative, union of cooperatives or another organization conducting business investment activities. Along with investment under contracts, investment in establishing business organizations is a direct investment in which investors invest and participate directly in management activities.

Compared to other forms of indirect investment such as buying stocks, bonds, other valuable papers, and investment funds, investing to establish an economic organization can be more complex and require more closely monitored investment procedures.

1.2.2. Investment in the form of capital contribution or purchase of shares or stakes

Investors must complete procedures for registering capital contributions, share purchases, or contributed capital to business organizations in the following cases - Foreign investors contribute capital, purchase shares, or contribute capital to business organizations operating in conditional investment and business lines applicable to foreign investors;

- The contribution of capital, purchase of shares, or contributed capital results in foreign investors and business organizations holding 51% or more of the charter capital of the economic organization.

1.2.3. BCC contracts signed between domestic investors comply with the provisions of civil law

- The BCC contract is signed between a domestic investor and a foreign investor or between foreign investors who carry out the procedures for granting an Investment Registration Certificate in accordance with Vietnamese law.

- The parties to the BCC contract establish a coordination committee to implement the BCC contract. Functions, duties, and powers of the coordination board shall be agreed upon by the parties

2. Legal Capital

In addition to the investment sectors specified in WTO commitments and specialized legal documents in some investment industries that limit the capital contribution ratio of foreign investors, However, in joint venture companies, foreign investors and Vietnamese investors can agree on their capital contribution ratio

Some investment areas where the percentage of foreign investors' capital contribution is limited: Road freight transport business (no more than 51%), Road passenger transport business (no more than 49%), services related to agriculture (no more than 51%), telecommunication services without network infrastructure (no more than 65%),…

3. Joint venture partner

Investors should carefully examine their partner and consider the required legal conditions related to the Vietnamese partner when making a joint venture with a foreign investor in the registered field.

For example: Service industries such as Advertising, film production, and video game business all require Vietnamese partners to be enterprises that have been licensed to operate in these fields.

4. Operating range

Foreign investors should also pay attention to the scope of the joint venture's activities. Because many business lines require conditions for foreign investors, it can cause difficulties in the process of implementing legal procedures on investment.

For example, foreign law firms are only allowed to operate in legal advice and other legal services. Foreign lawyers or Vietnamese lawyers in their practice organizations may not be sent to participate in proceedings as representatives, advocates, or defenders of other legal rights and interests of litigants before Vietnamese courts or perform legal and notarized services related to Vietnamese law. Not allowed to provide industrial property representative services, or industrial property assessment services.

5. Advantages and disadvantages

5.1. Advantages

- Firstly, Foreign investors when participating in a joint venture can leverage the combined resources of both companies to achieve the goals of the joint venture. One company may have a methodical production process, while the other may have superior distribution channels.

- Secondly, Foreign investors can save investment costs by using economies of scale, both companies in the joint venture, including foreign investors, can take advantage of their production activities at a lower cost per unit than individual companies. This is particularly pertinent to costly technological advances to make. Other cost savings resulting from the venture may include sharing advertising or labor costs.

- Thirdly, foreign investors can not only profit from the main business activities of the enterprise but also from joint ventures with other enterprises. When the enterprise operates profitably, the joint venture member will be entitled to share the profits but also only be responsible within the scope of contributed capital when the enterprise operates inefficiently.

5.2. Disadvantages

However, the form of a joint venture enterprise also has the disadvantage that there is a close bond in a common legal entity between completely different parties in language traditions, customs, practices, and business styles, so conflicts may arise that are not easy to resolve.

6. Order and procedures for establishing a joint venture enterprise

6.1. Conditions for establishing a joint venture enterprise

According to the provisions of the enterprise law 2020, investors also need certain conditions to establish a joint venture enterprise. The following are some conditions for establishing a joint venture enterprise:

- About the subject (investor):

- Individuals: Must have full civil act capacity, not during the period of serving imprisonment and other administrative penalties as prescribed.

- Legal entity: legally established, still active at the time of investing.

Thus, foreign enterprises that do not violate the laws of Vietnam and foreigners are not prohibited from establishing and undertaking enterprises as prescribed by Vietnamese law.

- Financial:

- The financial capacity of the investor must correspond to the amount of capital committed to investing in the project. That is, the investor must be able to afford to pay with the committed capital.

- The bank that keeps the money invested in the business is a legal bank and is allowed to operate in Vietnam.

- Legal capital of enterprises: meet the requirements under Vietnamese law on joint venture enterprises

- Following Vietnamese law, international treaties signed or recognized by Vietnam.

- The dossier of registration for the establishment of a joint venture enterprise must comply with the provisions of Vietnamese law (enterprise law, investment law, WTO commitment...)

In addition to the conditions for establishing a specific joint venture enterprise, the enterprise must ensure the conditions for establishing another enterprise by the provisions of the law.

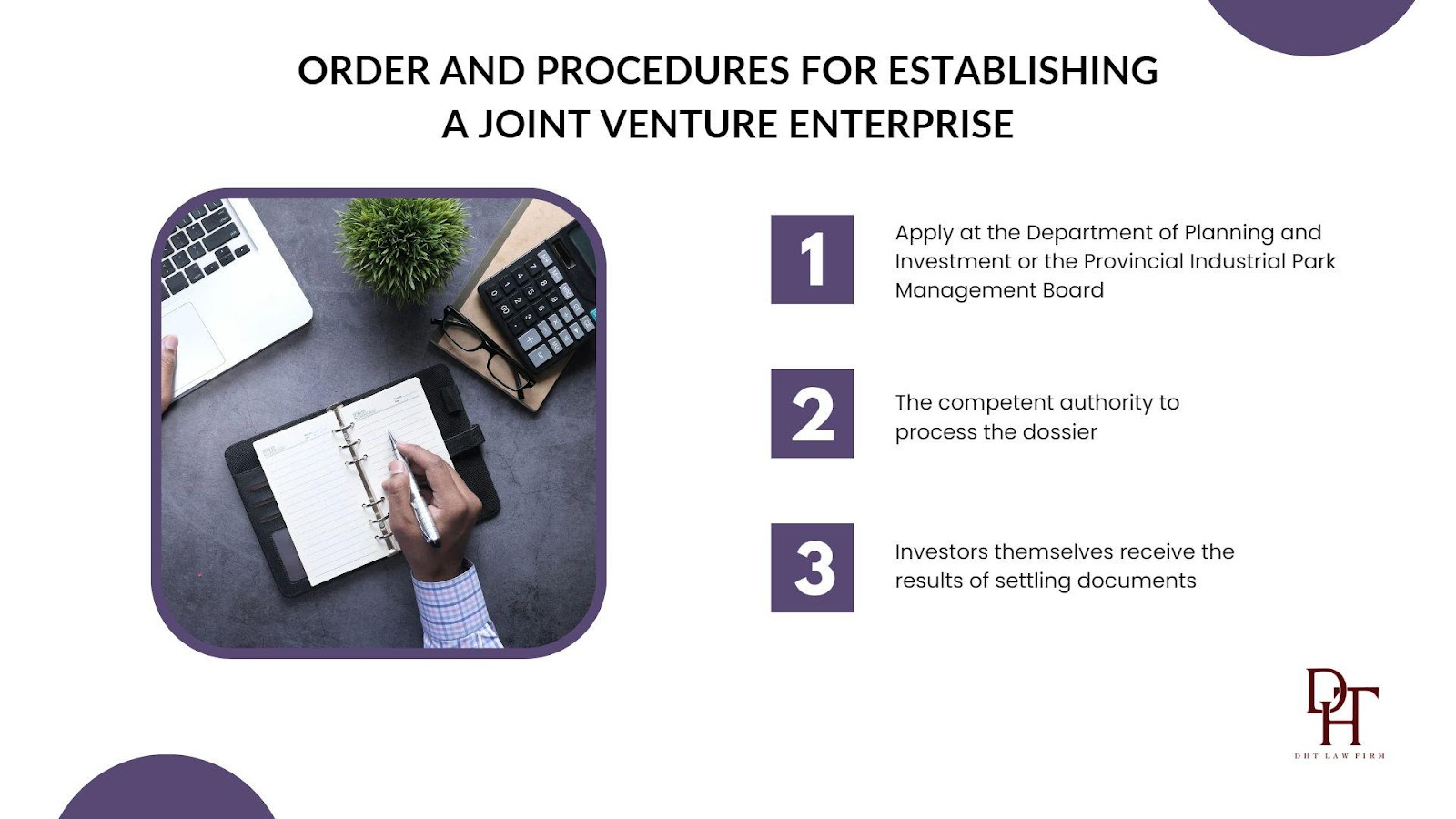

6.2. Dossiers and procedures for establishing a joint venture enterprise

According to the Law on Investment 2020, the establishment of a joint venture enterprise is a procedure for applying for an investment certificate simultaneously with the establishment of an enterprise. An investment certificate is also a Business Registration Certificate (Certificate of Business Registration). Accordingly, the procedure for applying for an investment registration certificate is carried out based on Articles 37, 38, and 39 of the Law on Investment 2020.

Step 1: The investor submits the application to the Department of Planning and Investment or the Provincial Industrial Park Management Board

Step 2: Department of Planning and Investment or Industrial Park Management Board:

- Application processing (if the application is valid)

- Notice of request to amend and supplement documents (if necessary)

- Submit to the Provincial People's Committee or the Director of the Industrial Park Management Board for approval

Step 3: Investors receive the results of settling the application:

- In case the dossier is invalid: As a result, the Notice of request to amend and supplement the dossier

- Where the application is valid: The result is the Investment Certificate as well as the Enterprise Certificate (Certificate of the establishment of a joint venture enterprise)

Above is the entire general study of Dai Ha Thanh Law Firm on the provisions of Vietnamese law related to notes for foreign investors when investing in the form of joint ventures between Vietnam and Foreign countries. If you have any questions or problems that need advice, please contact us for professional legal advice.