NEW LEGAL PROVISIONS ON E-COMMERCE ACTIVITIES FOR FOREIGN TRADERS AND ORGANIZATIONS IN VIETNAM

Along with the rapid development of science - technology in general and information technology in particular, e-commerce relations have been developing strongly in Vietnam in the context of a determined market economy along the socialist orientation, international economic integration. Currently, there are many e-commerce platforms such as Shopee, Tiki, Lazada, ...; digital wallets like Momo, Cake…; payment gateways and technology businesses such as Grab, Bee, Gojek...

According to a report from the Vietnam E-commerce White book released by the Vietnam E-commerce and Digital Economy Agency (iDEA), Vietnam's E-commerce industry has achieved 18% growth in 2020 with a scale of 11.8 billion USD. In addition, Vietnam is expected to become the fastest growing e-commerce market in Southeast Asia, with gross merchandise volume (GMV) predicted to be $56 billion by 2026.

On September 25, 2021, the Government issued Decree No. 85/2021/ND-CP amending and supplementing a number of articles of Decree No. 52/2013/ND-CP on e-commerce, in which regulations governing foreign traders and organizations having e-commerce activities in Vietnam are paid special attention. In this article, we - Dai Ha Thanh Law Firm would like to introduce new legal provisions on e-commerce activities for foreign traders and organizations in Vietnam as specified in Section 5, Chapter IV of Decree No.85/2021 ND-CP as follows:

Firstly, the scope of foreign entities governed by the E-commerce Decree is broader.

According to Decree 52/2013, foreign entities must comply with the provisions of the law on e-commerce, including foreign entities having presence in Vietnam through the form of investment, establishment of branches, documents representative office or having a website with a Vietnamese domain name. Decree 85/2021 has expanded the scope of application to foreign entities. Foreign entities having e-commerce activities in Vietnam subject to Decree 85/2021 include:

Case 1: The foreign entity has an e-commerce website (1) under the Vietnamese domain name (similar to the provisions of Decree 52/2013); or (2) the display language is Vietnamese; or (3) has more than 100,000 transactions from Vietnam in a year . For the third element, the number of transactions is determined according to the reports of the relevant foreign entities; or official data of the state management agency in charge of customs, tax, Internet management, banking; or publicly available reports and information that have been verified by a regulatory authority.

Case 2: Foreign entity sells goods on Vietnam's e-commerce platform: Carrying out goods sales activities in accordance with the Regulation on the operation of Vietnam's e-commerce platform.

Secondly, control the activities of foreign entities in Vietnam.

A foreign entity that operates an e-commerce website must register its e-commerce activities and either establish a representative office in Vietnam or appoint an authorized representative in Vietnam . This regulation is different from the old regulation under Decree 52/2013, which did not require foreign entities to have their own office or representative in Vietnam. This helps to limit cross-border e-commerce services provided by foreign suppliers to customers in Vietnam. Foreign entities that have e-commerce websites in Vietnam must complete the above requirements before the end of 2022.

For foreign sellers on Vietnamese e-commerce platforms, foreign sellers may have to appoint their own commercial agents in Vietnam. E-commerce platform owners must verify the identity of foreign sellers trading on their exchange.

Thirdly, market access conditions apply to foreign investors doing business in e-commerce services (such as e-commerce platforms, online auction websites, online promotion websites, etc.).

Decree 85/2021 reaffirms that e-commerce services are conditional business lines for foreign investors. Foreign investors are subject to two conditions of market access including:

Condition 1: Foreign investors can invest in e-commerce services in Vietnam by establishing a new company in Vietnam or investing in an existing company in Vietnam. That means, Other types of investment, such as business cooperation contracts or project implementation without a commercial presence in Vietnam, are not permitted;

National security appraisal by the Ministry of Public Security if foreign investors dominate one or more enterprises in the group of 5 leading enterprises in e-commerce services in Vietnam as announced by the Ministry of Industry and Trade. If the acquired company is an innovative start-up or a small and medium-sized enterprise, this condition will be waived..

Condition 2: A foreign investor is considered to be dominant in an enterprise if the investor:

(1) Owning more than 50% of the enterprise's charter capital or voting shares; and

(2) Directly or indirectly decide to appoint, relieve from duty, remove from office the majority or all of the members and the chairman of the Board of Directors, (general) director of such enterprise; or can decide on important issues in the business activities of that enterprise such as choosing a technology platform; form of business organization; selection of industries, occupations, geographical areas and business forms; adjust the scale and lines of business; select the form and method of mobilizing, allocating and using the business capital of that enterprise.

The national security appraisal by the Ministry of Public Security is a step in the process of applying for a business license for the relevant enterprise in the event that a foreign investor acquires a majority stake in a large e-commerce enterprise in Viet Nam. Therefore, in this case, it will take longer for the parties to finalize the legal requirements for the sale and purchase transaction.

Fourthly, the new form of e-commerce platform

According to the new regulations, a social network is considered an e-commerce platform if it meets all of the following conditions:

Social network has one of the following activities: (1) allows participants to open booths to display and introduce goods or services; (2) allows participants to open accounts to carry out the process of contracting with customers; or (3) has a buying and selling section, which allows participants to post information about buying and selling goods and services; and (4) such social network participants directly or indirectly pay fees for the performance of the above activities.

It can be mentioned that the e-commerce TikTok Shop has appeared in a new form in the Vietnamese market. Basically, TikTok Shop enables customers to buy and sell goods directly on the TikTok app. Previously, customers had to click on an affiliate link before making a transaction on Lazada, Shopee or other e-commerce platforms. At this point, the "Shop" icon in the application will take the user to the seller's list of goods. Here, users can search for goods and make purchases. In some markets, users can even make purchases and make payments through a livestream or TikTok video.

TikTok is also not the only social network that aspires to participate in e-commerce. Recently, many Western social networks have also promoted the development of new shopping features. In the midst of the pandemic, Meta launched Facebook Shops in May 2020, while Pinterest allows users to create favorite shopping lists and display ads based on user behavior. Last month, Twitter introduced Twitter Shops, allowing merchants to display up to 50 products on their individual Twitter pages. However, unlike TikTok, the major social networks mentioned above have not yet focused on Southeast Asia. For example, the payment feature on Facebook and Instagram is only available in the US.

Fifthly, supplement the responsibility of the service provider of the e-commerce platform with the function of online ordering.

In addition to general responsibilities, an e-commerce platform service provider with an online ordering function has the following obligations:

- Designating a focal point to receive requests and provide online information to government agencies about law-breaking subjects. This contact must provide information within 24 hours of receiving the request;

- Representing foreign sellers on e-commerce platform to settle consumer complaints about goods and services provided by foreign sellers and notify tax obligations that foreign sellers have to fulfill;

- Acting as the focal point to receive and resolve consumer complaints if the transaction is made on an e-commerce platform with more than two parties involved;

- Storing information about order transactions made on the e-commerce platform in accordance with the law on accounting; and

- Jointly compensating for damage caused by violations of the obligation to handle legal violations occurring on the e-commerce platform.

Sixthly, new procedure for registering for e-contract attestation services

Previously, service providers of electronic contract attestation needed to apply for a license from the Ministry of Industry and Trade. The government is now changing licensing to the registration of electronic contract attestation services. The results of successful registration include (1) confirmation of the registration of the electronic contract attestation service issued by the Ministry of Industry and Trade and (2) the supplier's name being updated in the list of registered e-contract attestation service providers published on the E-commerce Operations Management Portal.

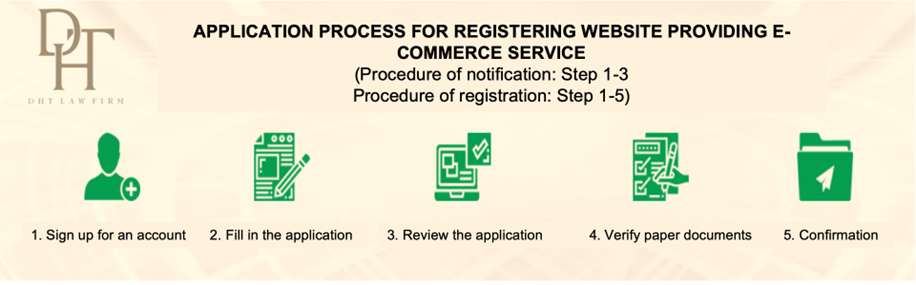

With the new e-commerce legislation provisions, foreign traders or organizations seeking to conduct e-commerce in Vietnam need to carry out procedures for registration and notification of e-commerce websites/applications according to the following process:

Step 1: Sign up for an account

- Access the website: http://online.gov.vn/;

- Click on the “Register” button;

- After clicking on the “Register” button, there will be a screen to fill in registration information;

- Click the “Submit Registration” button to complete Step 1: Sign up for an account.

After submitting the account information successfully:

- The trader/organization will receive an email from the Ministry of Industry and Trade, the Ministry of Industry and Trade will review the registration information of the trader/organization within 3 working days and send an email feedback on whether the trader/organization's registration is successful or not.

- In case the trader/organization has not received an email from the Ministry of Industry and Trade for more than 3 days, please contact the phone number: 024 222 05 512 to read the Tax Code to inquire about whether the account registration has been successful.

Step 2: Declare the type of commercial service

- Access the website: http://online.gov.vn/HomePage.aspx;

- Fill in information: Username, password;

- Click: “Notify website” to make the announcement;

- Enter the website name information;

- Enter the website domain name and enter all the domain names pointing to the website if any;

- Select the type of goods and services provided by the website: click the “Select” button to select the type of goods and services provided;

- Provide the name of the hosting service provider;

- Select “Attachment file” to move to the next step (For website owners who are businesses/companies need to scan or take a photo of the business registration license to upload files);

- Click on the “Select file” button to upload the business registration license to the profile, after selecting the file, click “Upload file”;

- After uploading the file successfully, select "Send profile" to complete the process of website notification.

Step 3: Review application

After 3 working days, the Ministry of Industry and Trade will notify you by email or log in to your account to check if your application has been approved or not. In case the application has not been approved, it is necessary to provide or correct the information as required.

Step 4: Verify paper documents

In case of website notification for sales e-commerce applications, skip this step. As for websites and applications providing e-commerce services that conduct the website registration process with the Ministry of Industry and Trade, they must send a set of documents (paper copies) to complete the registration according to regulations. If traders and organizations do not respond within 30 working days from the date of notification of amendment or supplement of information, they will have to re-register from the beginning.

Step 5: Confirmation

Within 05 (five) working days from the date of receipt of the final paper application, the trader or organization is certified to register and then receives a code that, when attached to the website, will be displayed with a registration icon.

In conclusion, the website registration process with the Ministry of Industry and Trade has been detailed and specific above. If you have a need to conduct business activities on the website, please register to ensure safety and improve operational efficiency.

E-commerce is a fast-growing and gaining popularity business model that is suited for the growth of the modern economy since it benefits consumers by promoting convenience, reducing costs, and saving time. Therefore, the development and completion of the legal framework for e-commerce requires a special consideration, a commitment to staying current with global trends, and compliance with international legal standards in the current era of integration!

Above is the general advice of Dai Ha Thanh Law Firm on the new provisions of the law on e-commerce activities for foreign traders and organizations in Vietnam. If you have any questions or issues, please contact us to receive professional legal advice.