NOTED LEGAL ISSUES RELATED TO CONSUMER LOAN ACTIVITY OF FOREIGN-INVESTED ENTERPRISES (FIE) IN VIET NAM

Vietnam's consumer credit industry has grown enormously in the past 10 years. According to data from the State Bank, the growth of consumer payment credit is always higher than the growth of outstanding payment credit across the entire financial economy. Outstanding consumer loans at the end of 2020 reached 1.85 million billion VND, accounting for 20% of the total loan balance of the whole economy. With a large population, the consumer credit market in general, and consumer loans, in particular, have become more vibrant and have more potential than ever. Therefore, this is a "fertile land" that attracts much attention from foreign investors. The proof is that in recent years, more and more foreign enterprises have invested in lending, especially consumer loans. Therefore, We - Dai Ha Thanh Law Firm will provide some noted legal issues related to consumer loan activity of foreign-invested enterprises in Viet Nam.

1. Overview of consumer loan activities

1.1. Definition of consumer loan

A consumer loan is one of the forms of credit granted by credit institutions, in which loans are granted to individuals and households by banks or financial companies to satisfy clients’ spending needs.

Depending on the type of customer, the purpose of the loan, the loan amount, or the loan term, a credit institution can provide consumer loans with or without collateral. Currently, this is an important source of finance to help consumers cover their housing needs, and purchase household appliances, vehicles, education, health care, and other services.

1.2 Types of consumer loans

1.2.1 Mortgage consumer loan

- This is a form of consumer loan that requires collateral. To be approved by the bank and financial companies for a mortgage loan, the borrower is required to mortgage valuable assets owned by him or her, it can be real estate or movable property.

- 3 notes related to mortgage consumer loans:

+ Required by the bank: because every loan has certain risks, collateral is a mandatory condition and is also the final binding for the bank to recover capital in case of risks.

+ Ownership does not change: the mortgaged property is still completely owned by the customer during the loan process, and the customer still uses the property normally without any influence.

+ Collateral will be recovered only if the customer is insolvent.

Pros: Low-interest rates, much more stable than unsecured loans. This is also the outstanding advantage of the mortgage loan because the bank has secured the loan with the customer's assets, and the method of payment of interest is flexible, meeting the large loan needs of the customer. The loan amount can be up to several billion or several tens of billion depending on the equivalent value of the collateral, long loan period, and simple and quick application procedures.

Cons: Customers are required to have collateral to mortgage the loan. In case the customer fails to pay the debt, they will lose the ownership of the collateral. Therefore it is risky and the time to disburse is longer.

Therefore, customers who demand a loan capital should carefully consider and calculate many factors such as debt repayment ability, interest rate, and penalty level (if any) before choosing a mortgage loan.

1.2.2 Unsecured consumer loan

An unsecured consumer loan is a form of loan that does not require collateral, the loan is almost entirely based on the customer's reputation. To confirm credibility, the borrower must prove specific information such as income, invoices, valuable contracts, etc.

Pros: The advantage of this form is that customers do not need to use collateral, and do not have to prove income. You do not have to worry about asset preservation, damage, or loss of assets when taking out an unsecured loan.

Cons: The limitation of unsecured loans is the low disbursement amount and high-interest rate, so customers often choose the form of mortgage loan for loans. Therefore, for customers who do not have assets to secure, or do not know what a consumer loan is, the form of an unsecured loan is more suitable.

2. Notes on the form of establishing a foreign-invested enterprise in the field of consumer loan

Because the scope of business activities is limited to only one or some banking activities, specifically in the field of consumer loans, this is the activity of a non-bank financial institution. Therefore, this is a conditional business investment industry. According to the WTO Schedule of Commitments to which Vietnam is a member, foreign investors can invest in the field of consumer lending in the form of establishing a company under the form of capital contribution from the beginning or purchase of shares/capital contribution in the existing Company.

Establishing a foreign-invested company in the form of investors contributing capital from the beginning: Accordingly, foreign investors will contribute capital right from the beginning of the company establishment in Vietnam.

Establishment of a foreign-invested company in the form of capital contribution or share purchase: In this form, foreign investors will contribute capital to a Vietnamese company that already has an enterprise registration certificate. Foreign investors will carry out procedures to purchase contributed capital and shares of Vietnamese companies. After that, the Vietnamese company became a foreign-invested company.

According to the existing law, Article 7 of Decree 01/2014/ND-CP, has specific regulations on different share ownership rates corresponding to each type of foreign investor in credit institutions in general and commercial banks in particular.

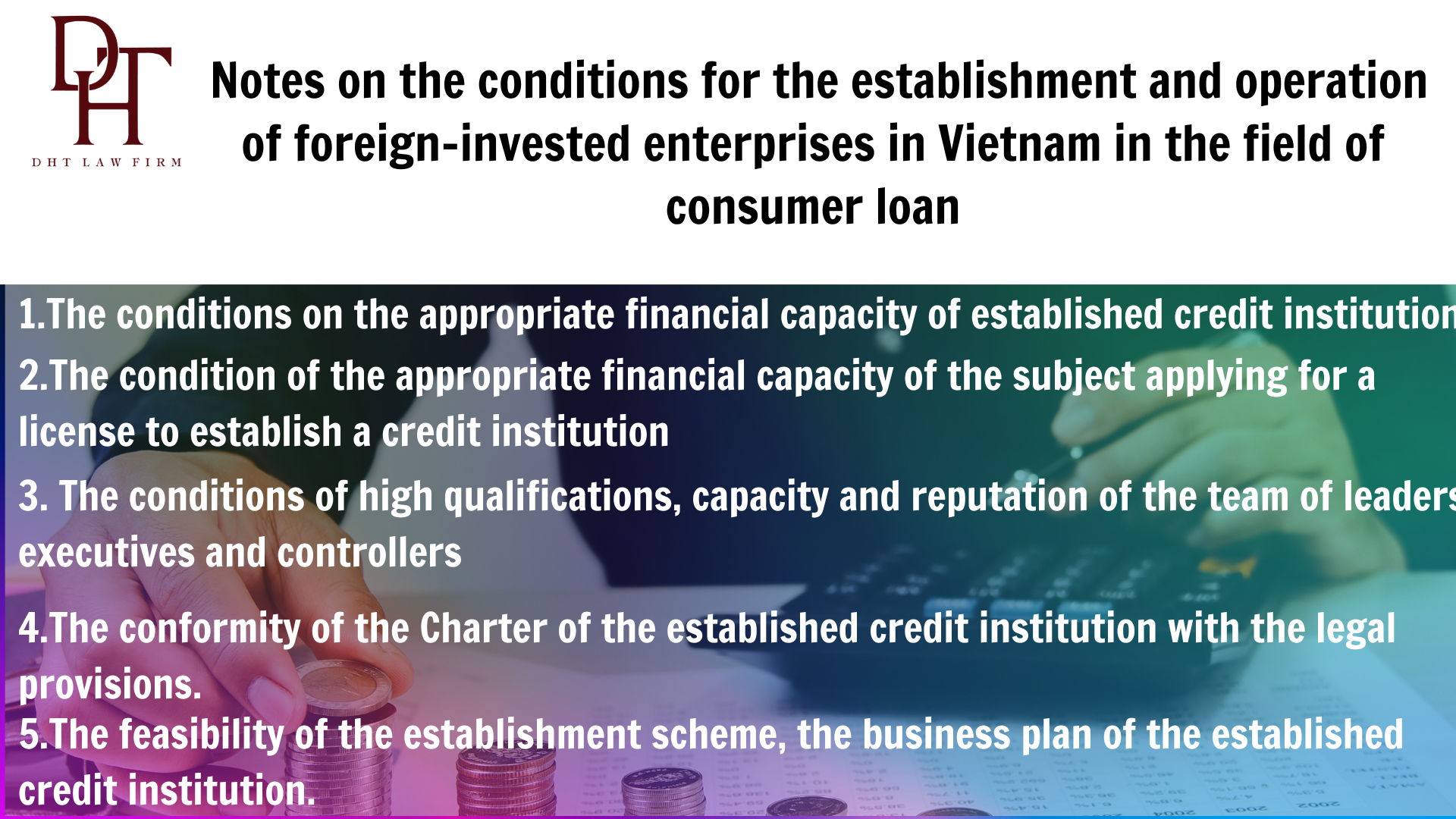

3. Notes on the conditions for the establishment and operation of foreign-invested enterprises in Vietnam in the field of consumer loan

- First, conditions on the appropriate financial capacity of established credit institutions:

In currency business, capital is not only the basis for conducting business, covering costs, and compensating for business risks but also a measure of customers' trust in credit institutions. Therefore, this criterion is the basis for ensuring the fulfillment of financial obligations of credit institutions after they are established and come into the business.

In addition, for non-bank credit institutions, the scope of business activities is limited to only one or a number of banking activities, specifically, this is the field of consumer loan activities. the suitable financial capacity will not require a high level of legal capital as for credit institutions which are banks. Specifically, in Decree No. 86/2019/ND-CP, the legal capital condition for financial companies with foreign capital is 500 billion, and for financial leasing companies with foreign capital is 150 billion.

- Second, the condition of the appropriate financial capacity of the subject applying for a license to establish a credit institution

This condition comes from the requirements of currency business because this is a risky business so credit institutions must be established by owners with high reputations and appropriate financial capacity.

For non-bank credit institutions: founding shareholders and founding members have a commitment to be responsible for the legality of the contributed capital source, and a commitment to provide financial support to solve difficulties in the case of non-bank credit institutions, or solvency and liquidity; In case the founding shareholder or founding member is a foreign organization, the business operation must be profitable for 03 consecutive financial years before the year of submitting the application for a license and by the time of submission of additional documents to be considered for a License.

For non-bank credit institutions with limited liability: Foreign credit institutions with total assets of more than 10 billion USD at the end of the year before the time of applying for a License; In case a foreign credit institution is a leasing company, the balance of finance leasing and lending must account for at least 70% of the total assets of the company.

- Third, conditions of high qualifications, capacity, and reputation of the team of leaders, executives and controllers

Foreign-invested enterprises should pay attention to the qualifications, capacity, and reputation of the team of leaders, executives and controllers to ensure full civil act capacity and professional qualifications, professional qualifications, prestige in financial capacity, experience in management and operation, professional ethics, not prohibited by law. The conditions for the team of leaders, executives and controllers of credit institutions licensed for establishment are specified in Articles 20, 21, 22, 23 of Circular 03/2018/TT-NHNN.

- Fourth, the conformity of the Charter of the established credit institution with the legal provisions.

The Charter is considered the "constitution" of the credit institution when a dispute arises. Therefore, the conformity of the Charter of the credit institutions with the legal provisions is of special significance to ensure the organization and operation of the credit institutions in accordance with the provisions of the law. The current Law of Credit Institutions has outlined the basic contents of the Charter such as name, location of headquarters; content and duration of operation; terms of capital; terms of duties, powers, selection criteria, election and appointment…

- Fifth, the feasibility of the establishment scheme, the business plan of the established credit institution.

To meet this criterion, enterprises need to pre-determine their establishment project, specific business plan with scientific and practical bases, determine the efficiency and economic benefits that can bring to credit institutions and the economy, thereby ensuring efficient operation and full ability to fulfill obligations in the business process. Accordingly, when an enterprise is established, it must fully meet the established criteria in accordance with the law, have a specific business plan, and have measures to ensure security and prevent risks to ensure the safety and stability of the enterprise itself as well as for the whole system of credit institutions in the economy; does not create a monopoly or restrict competition or unfair competition in the credit institution system.

4. Current situation of foreign-invested enterprises in the field of consumer loans

According to the WTO schedule of commitments to which Vietnam is a member, foreign-invested credit institutions are allowed to have a commercial presence in Vietnam in the following forms: representative offices, joint-venture finance companies, financial companies having 100 % foreign invested capital, joint venture finance leasing company and 100% foreign invested finance leasing company. Therefore, foreign investors can establish a Company with a foreign ownership rate of up to 100% in the form of a single-member limited liability company. However, the procedure for issuance of a License for establishment and operation is quite complicated and expensive because it has to meet the conditions for establishment and operation as mentioned above. Therefore, many foreign investors have circumvented the law by establishing ordinary companies with normal business lines to operate consumer loans in Vietnam. These companies have hidden in the shadow of "black credit" when lending to consumers with extremely high-interest rates, about 38%/month, equivalent to 456%/year. Meanwhile, commercial banks in Vietnam lend at an interest rate of about 7-27%/year.

5. Recommended solution

Therefore, in order to minimize possible risks, investors need to carefully understand and fully comply with the conditions on market access and operating conditions before conducting consumer loan activity after consulting with a professional legal consultant. In addition, we recommend that investors do not register a disguised business line for the purpose of circumventing the law because of the great risk of liability.

6. Conclusion:

Above is an entire overview of Dai Ha Thanh Law Firm’s advice about noted legal issues related to consumer loan activities of foreign-invested enterprises in Vietnam. From there, we give recommendations for solutions to practical risks so that investors/enterprises can note them and apply them in this field. We, the Dai Ha Thanh Law Firm, with a team of professionally trained lawyers, and legal advisors, are committed to providing professional legal services to our clients. If you need specific advice, please contact us to receive professional and effective legal consulting services.