LEGAL ISSUES WHEN CONTRIBUTING CAPITAL WITH TRADEMARKS AND PATENTS IN VIETNAM NOWADAYS

1. Overview of capital contributions by trademarks and patents

According to Clause 18, Article 4 of the Enterprise Law 2020, capital contribution is a legal act whereby a capital contributor contributes his/her assets to the charter capital of the company.

Unlike normal assets, trademarks and patents are special intangible assets that need to be valued. But in fact, the value of both spiritual and material aspects is not easy to determine. Accompanying these are relevant legal issues such as how to contribute, how to price, deliver, and receive trademarks, patents, and capital contributions, and the term of protection of trademarks and patents.

Up to now, the legal system of Vietnam has not had specific documents guiding the issue of capital contribution by trademarks and patents to enterprises, however, the law does not prohibit the contribution of capital by trademarks or patents, and in fact this capital contribution has been quite common. Procedures for capital contribution with trademarks and patents are carried out through: Valuation of trademarks and patents, making capital contribution contracts, transferring the ownership of trademarks and patents to enterprises, and granting certificates of capital contribution.

Through the form of enterprise capital contribution by the value of the patent ownership, the owner will transfer his/her property rights specified in Clause 1, Article 123 of Intellectual Property Law. After the transfer, the enterprise will become the new owner of the invention and exercise rights such as: the right to use the invention and permit others to use the right to use the invention, this is to maximize profits from the use of the invention, as provided for in Clause 1, Article 124 of the Intellectual Property Law. Enterprises have the right to prevent others from using their patents as provided for in Article 125 of the Intellectual Property Law. The enterprise has the right to dispose of the invention, including the rights to assign the invention and to license the right of use to the invention.

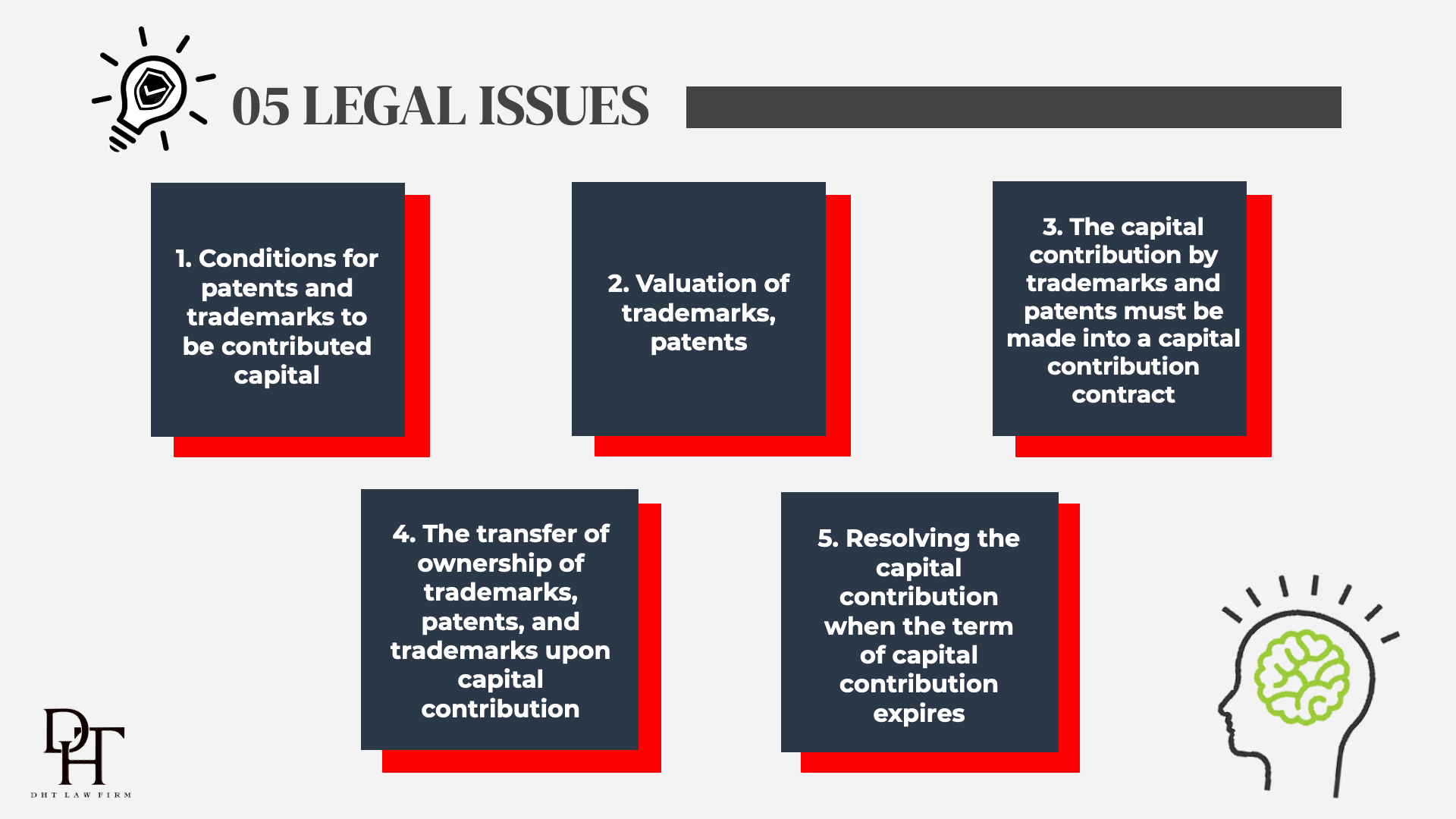

2. Legal issues when contributing capital with trademarks and patents

First, conditions for patents and trademarks to be contributed capital

The prerequisite to contribute capital with a trademark or invention is that the owner of the trademark or invention must register intellectual property rights with a competent state agency, in other words, the object of capital contribution needs to be specified in the form of a document, with the recognition of the competent state agency. Such patents and trademarks must be legally owned by the subjects contributing capital. The identification of the legal owner of an invention is determined on the content of the protection title, similar to the certificate of trademark registration. At the same time, the contribution of capital to patents and trademarks is only permitted within the scope and term of protection.

Second, valuation of trademarks, patents

In fact, the activities of buying, selling, merging or buying shares of joint stock companies exist a great deal of difficulties because the valuation of IP rights in Vietnam has not been specifically guided by the law and there are many different opinions of state agencies on this issue. The valuation of assets contributed as capital, especially trademarks and patents which needs to be unanimous for determining asset prices, is relatively complicated.

Therefore, in order to limit disputes arising, the property valuation needs to be coordinated with competent people to arrive at a reasonable price. The provisions of the Enterprise Law on valuation competence have created favorable conditions for companies to value contributed assets. A professional valuation organization may have the authority to set prices at the request of its members.

In the world, IP valuation methods are divided into two large groups: quantitative valuation methods and qualitative valuation methods.

The quantitative valuation method is commonly applied at the Patent Office of Japan, the Patent and Trademark Office of Denmark, the European Patent Office, etc. to evaluate and rank IP assets such as patents and trademarks based on factors such as the degree and scope of influence of rights on each IP object and the protection ability of these objects. According to the quantitative method, IP objects are evaluated on three aspects: valuation of rights; valuation of the transferability of IP objects; valuation of business potential. The disadvantage of this method is that it depends a lot on the subjective assessment of the appraiser, so it will be very difficult to foresee the next evolution of the IP property because the assessment is completely subjective. Due to their subjectivity, the evaluation results may influence management decisions related to IP assets and technology transfer activities.

Qualitative valuation method: A method based on measurement and data analysis to calculate the value of IP objects into money, including the following three widely applied approaches: (i) cost; (ii) market; (iii) income. In particular, the cost approach is not widely used for the valuation of patents because it does not reflect the economic value, future profitability of the assessed invention, there is no correlation between cost and value of assets, it is difficult to distinguish between normal operating expenses and investment costs for the company's IP assets, and the subjective nature of estimating replacement costs with patents no substitute. The market approach is also rarely used because it is difficult to conduct due to the lack of clarity, information about the IP object being traded as a basis for value comparison. Therefore, the approach (iii) is prefered when valuing trademarks and patents to contribute to the company.

The decision on the value of assets contributed as capital will be discussed in the meeting by the Board of Directors of the joint-stock company, the Members' Council of the limited liability company and all general partners of the partnership. Valuation of assets in order to accept new members means that amendments to the Charter can only be approved when 50% of the members, founding shareholders or capital contributors and owners, the Members' Council, Board of Directors approve.

Third, the capital contribution by trademarks and patents must be made into a capital contribution contract

The contribution of capital with the value of IP rights means that the capital contributor has transferred the property rights (or part of the property rights) to the capital contributor but has not transferred the personal rights to the capital contributor.

For capital contribution with Trademarks of goods/services, the above principles must also be followed. The capital contributor will use the value of the right to use the trademark to contribute capital without transferring or changing the owner on the certificate of trademark registration issued by a competent state agency.

Because of the above-mentioned incomplete transfer, the parties need to make a capital contribution contract that clearly and fully stipulates the rights and obligations of the parties to contribute capital. The capital contribution contract is considered as a part of the company establishment contract, in form it can be called an appendix, minutes, capital contribution agreement,…

Fourth, the transfer of ownership of trademarks, patents, and trademarks upon capital contribution

The provisions on the transfer of property ownership in the Enterprise Law 2020 cannot be fully applied to the capital contribution with the value of IP rights. Since an owner of an IP right can simultaneously own two rights, these are moral rights and property rights (e.g. copyright). In fact, they only contribute capital with the value of property rights, so the ownership is not completely transferred, only some separate property rights, for example granting the right to use a trademark or an invention. This is also the fundamental difference between capital contribution with ordinary assets and capital contribution with value of IP rights.

In this case, the capital contributor party and capital receiver party will make a record of asset delivery, a record of asset valuation and capital contribution contract. This is the legal basis to determine the transfer of IP rights when contributing capital to the company.

Finally, resolving the capital contribution to trademarks and patents when the term of capital contribution expires

In the Enterprise Law 2020, Article 53 regulates the handling of contributed capital in some special cases such as the death of an individual member, loss of civil act capacity, dissolution or bankruptcy of an organization, transfer, contributed capital, donation, debt repayment with capital contribution,… without any regulations regarding the handling of the contributed capital as the value of IP rights upon the expiration of the protection term or the expiration of the capital contribution term.

So with the characteristic of being intangible assets, the term of capital contribution must be within the protection period of the mark or invention under Clause 6, Article 93 of the Intellectual Property Law “the certificate of trademark registration takes effect from date of issue until the end of ten years from the date of application, may be renewed for several consecutive times, each ten years”. When contributing capital, based on the time limit specified in the capital contribution agreement to determine the expiration date of this agreement, when contributing capital in the form of trademarks or patents, the parties must enter into a contract to transfer the ownership or use rights and register at the National Office of Intellectual Property. This contract is considered as the basis for determining the effective term of the capital contribution agreement according to the term of trademark protection. But in reality, the capital contribution agreement is not. If it is still valid, the capital contributor will lose his/her membership status or reduce the value of the contributed capital, and the company must carry out procedures for reducing its charter capital.

If the capital contribution is equal to the value of trademark ownership, then when the contract (agreement) on capital contribution expires, the party receiving capital contribution which is the value of trademark ownership will continue to use the mark or invention (because after completing the procedures for transferring ownership when contributing capital, the party receiving capital contribution shall be the owner of such trademark or invention). So now, does the company have to carry out procedures to reduce charter capital? Currently, the Enterprise Law 2020 has no guidance related to this case, so if it arises, it will be difficult to solve.

Above is the entire overview of Dai Ha Thanh Law Firm on basic legal issues when contributing capital with trademarks and patents in Vietnam. From there, we provide an analysis of practical risks so that individuals/organizations can note and apply when they want to contribute capital with trademarks and patents. Dai Ha Thanh Law Firm, with a team of professionally trained lawyers, legal advisors, is committed to providing professional legal services to customers. If you need detailed advice, please contact us for professional and effective support.