REGULATIONS ON CONVERSION OF LOAN INTO EQUITY

Companies mainly raise finances through share capital (by issuing equity and preference shares) and loans (by issuing bonds/debentures). While shares and debentures are issued to the investors and can be tradeable on the exchange, both are methods of raising capital – shares are called own capital, and debentures are called borrowed capital.

In recent years, many Vietnamese enterprises, especially small and medium-sized enterprises, have chosen to borrow capital from abroad to develop or maintain economic activities, however, for many different reasons, many loans become bad debts. For that reason, in this periodic publication, Dai Ha Thanh limited liability law company respectively sent to our Clients some general regulations of Vietnamese law on the issue of converting foreign loan into shares or contributed capital in the enterprise.

I. Overview of the method of converting loan into shares or contributed capital

1.1. Regulations regarding Foreign loan

|

|

|

|

|

|

Depending on each type of loan, specific regulations on conditions, borrowers and dossiers, legal procedures that need to be carried out will be different. Therefore, the most important issue is that Vietnamese businesses need to consider and determine which case their business loan falls into.

1.2. Definition on method of converting loan into shares or contributed capital

Converting a loan into shares or contributed capital is converting a debt into an investment. The Lenders, foreign enterprises or individuals, become Investors in the method of investment by contributing capital and purchasing shares of the Borrowers. In other words, the Lenders have invested in the Borrower's enterprises but completed the investment payment before officially becoming a member or shareholder in the Borrower's enterprises.

Notes: Normally, when referring to a business's capital source, two terms will be mentioned: charter capital and equity capital. These are two essential types of capital in business operations. Meanwhile, converting a loan into shares or capital contribution will affect the capital source of the Borrower's business. Therefore, distinguishing between Charter Capital and Equity will help Clients better understand the nature of this activity.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

II. Regulations on method of converting loan into shares or contributed capital

Pursuant to current regulations, Vietnamese enterprises (hereinafter referred to as “the borrowers”) must open loan accounts at providing account-services banks or using direct investment capital accounts to perform remittance transactions (including repayment transactions) related to the foreign loan. However, there are several cases in which the Borrowers cannot repay debt when due, which affects Vietnam's foreign loan borrowing activities.

Therefore, to improve the flexibility of foreign capital borrowing and repayment activities, as well as to promote the ability to mobilize foreign capital, the Borrowers can choose a method of debt-repayment not through a loan account, specifically:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thus, converting a loan into shares or contributed capital is one of the methods by which the Borrowers repay debt to the Lenders without using the loan account at the bank.

1.3. Conditions for converting loan into shares or contributed capital

Currently, the law does not have any specific regulations about the conditions for converting foreign loans into shares or contributed capital in the enterprises. Nevertheless, in reality, the Vietnamese enterprises have to meet some basic conditions to make the transition happen quickly, and smoothly, as follows:

- The legality of the loan: ensuring that the loan is used in accordance with the loan-use plan registered with the State Bank, and that all obligations related to the loan registration have been fully done and on time implemented, periodic loan reporting;

- There must be an agreement between the parties on converting loan into shares or contributed capital;

- The Lenders must meet the conditions for receiving foreign investors in the form of capital contribution investment, purchase of shares or capital contribution of the Borrower in terms of market access conditions and capital ownership ratio in businesses and other conditions related to defense and security activities in the territory of Vietnam.

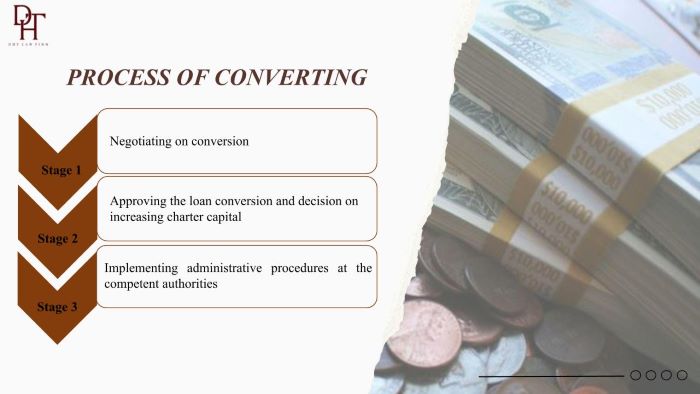

1.4. The process of converting loan into shares or contributed capital

Primarily, the process of converting a loan into shares or contributed capital has three main stages, including: (i) negotiating on conversion, (ii) approving the loan conversion and decision on increasing charter capital and (iii) implementing administrative procedures at the competent authorities

|

|

|

|||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|||

|

|

|

|||

Above are the basic legal issues related to converting loans into shares or capital contributions in a business. Dai Ha Thanh limited liability law company, with a team of Lawyers and Legal Advisors who have extensive expertise and practical experience, is committed to providing professional legal services to our customers. In case you have any questions related to this issue, please contact us to be provided with professional and effective legal consulting services.