LEGAL PROVISIONS ON TAX MANAGEMENT FOR BUSINESS ACTIVITIES ON SOCIAL NETWORKS

Business activities on social networks are currently in a “boom period” with a rapid growth rate. Buying and selling goods, providing services through social networks is attracting a large number of individuals and organizations to participate. One of the most concerning issues for businesses on social networks is tax management for this activity. Tax management for business activities on social networks has many important meanings for the State as well as business entities. Within the scope of this article, Dai Ha Thanh Law Firm will provide information on legal regulations related to tax management for business activities on social networks.

1. Overview of tax management for business activities on social networks

1.1. Overview of business activities on social networks

According to the provisions of Clause 22, Article 3 of Decree 72/2013/ND-CP, a social network is defined as an information system that provides the network user community with services of storing, providing, using, searching, sharing and exchange information with each other, including services for creating personal websites, forums, online chats, sharing audio, images and other similar services.

Regarding the concept of business, Clause 21, Article 4 of the Enterprise Law 2020 defines Business as the continuous performance of one, several or all stages of the process from investment, production to product consumption or supply services in the market for the purpose of making a profit. Based on the two concepts set out above, it can be understood that "social network business" is a type of service that delivers products, taking place on the social networks via the Internet that both the seller and the customer use social networks.

According to the provisions of the Enterprise Law 2020, business activities will include the following basic characteristics:

(i) Carry out one, several or all investment, production, supply activities

(ii) Activities that take place in the market

(iii) Activities carried out for the purpose of making a profit

In the context of digital development, business is not only limited to transmission methods but has expanded to more diverse forms, especially business on social networks. Doing business on social networks is essentially putting business activities on the Internet environment. Accordingly, individuals and organizations will buy and sell goods, provide services to customers through social networking sites such as Facebook, Tiktok, Instagram, etc. In this way, the exchange and negotiation of prices, payment methods, delivery will be done entirely through the online chat system or comment on these social networking platforms.

1.2. Characteristics of business activities on social networks

Business on social networks has very different characteristics compared to traditional forms of business, specifically:

Business on social networks is a form of e-commerce

Commercial activities in general or business on social networks in particular are commercial activities carried out on information technology platforms connected to the Internet. However, neither e-commerce nor social networks business includes production in the investment process. In other words, social networks or e-commerce only provide tools to connect and link between buyers and sellers.

Business on social networks may not need business registration

According to the general provisions of Vietnamese law, the subject of business activities is generally organizations and individuals that must or must have a business registration. Article 6 of the Commercial Law 2005 stipulates that “Traders include legally established economic organizations and individuals conducting commercial activities independently, regularly and with business registration”. Therefore, it can be said that the business subjects here are enterprises established under the Enterprise Law; cooperatives established under the Law on Cooperatives; business households, or individuals with business registration. These are called merchants and are all obligated to register their businesses.

However, besides the business entities with business registration obligations as above, there are also the following business entities that are excluded by Vietnamese law from the business registration obligation. According to Vietnamese law, specifically Decree 78/2015/NĐ-CP, in the case of small, low-income business entities, who do not have a fixed business location, they do not need to register their business. Thus, it can be seen that the subject of business on social networks is an individual, if it is only a small business with low income, it is not required to register a business, nor to register business activities through social networks.

Business activities on social networks are difficult to identify information

Subjects conducting business activities on social networks are carried out through information technology means such as mobile phones, computers, etc., which can be done anytime, anywhere, unlike the traditional business system that has at least one fixed place of business to determine the place of business. In addition, information about buyers and sellers is often not clearly authenticated, social network users often change names, delete accounts, or a person can own many different accounts, so it is difficult to identify and get information about buying and selling as well as information related to the transaction.

1.3. The importance of tax management for business activities on social networks

With the rapid development of business through social networks, the State's enactment of regulations and policies on tax management for this activity has brought a benefits, specifically:

1.3.1 Ensuring revenue sources into the state budget

Although taxes have their own regulatory purposes, they all have the same important role as certain amounts to be collected in the state budget. In essence, tax is the basic and long-term revenue of the State. Tax is a compulsory contribution of individuals and organizations to the State in order to ensure the common interests of the whole society. Therefore, the collection of taxes on business activities on social networks not only ensures the revenue of the state budget but also aims at the common interests of society.

1.3.2 Ensuring equality for business entities

In addition to ensuring revenue for the state budget, the tax collection for business activities on social networks is also aimed at fairness between business entities. Accordingly, from a business perspective, the principle of fairness is clearly reflected in the characteristics of business entities, when having sufficient grounds according to the provisions of the law, are obliged to pay tax. Therefore, when conducting business activities, individuals and organizations, regardless of method, are obliged to pay taxes to the State.

Hence, according to the law on tax management, all individuals and organizations that generate income, purchase and sale activities that give rise to tax obligations are responsible for registration, declaration and payment of tax. The fairness between business entities is clearly demonstrated by the fact that, whether conducting business activities in the traditional form or through social networks, they must fulfill tax obligations to the State.

2. Law on tax management for business activities on social networks

2.1. Legal regulations on tax registration for business activities on social networks

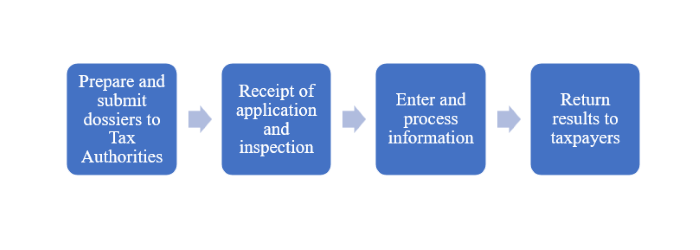

Tax registration is the act that taxpayers declare to tax authorities about their identification information for the purpose of distinguishing many taxpayers from each other. For business entities, it is information about full name, age, occupation, address, etc. After the taxpayer completes tax registration procedures, the tax authority will issue a tax identification number. The current tax registration management process can be summarized as follows:

The Tax Management Law 2019 and its guiding documents have specified contents related to the order, procedures and registration dossiers for business on social networks as follows:

- Tax registrants

Tax registrants are social media entities who have performed business acts or have incomes that give rise to tax legal relations as prescribed in Point i, Clause 2, Article 4 of Circular 105/2020/TT-BTC.

- Tax registration time

Register tax directly with the tax authority within 10 working days from the date of personal business on social networks

- Registration dossiers and places to submit tax registration dossiers

A dossier for registration of personal income tax and value-added tax includes the declaration form 03-DK-TCT, a copy of the valid citizen ID or people's identity card, for individuals who are Vietnamese nationals, or a copy of a valid Passport for individuals who are foreign nationals.

According to the provisions of Point a, Clause 8, Article 7 of Circular 105/2020/TT-BTC, tax registration documents will be submitted at the Tax Department where the individual resides.

- About the order and procedures for granting tax identification numbers

After receiving a complete tax registration dossier and related papers, the tax authority is responsible for granting a tax registration certificate according to Article 34 of the Law on Tax Management 2019, Circular 105/2020/TT-BTC according to the Law on Tax Management form No. 10-MST, form No. 11-MST, form 12-MST within 03 working days.

The information on the tax registration certificate includes information about the taxpayer's name; tax code; information about identity card number or citizen identification number or passport; address, date of issuance of tax identification number, direct management agency.

After having a tax identification number, the taxpayer must write the tax identification number in invoices, vouchers and documents when conducting business transactions or opening a deposit account at a commercial bank or other credit institution, etc. according to the provisions of Article 35 of the Law on Tax Management 2019 on the use of tax codes.

2.2. Legal provisions on tax declaration and payment for entities conducting business activities on social networks

Tax declaration is a mandatory obligation of taxpayers when tax obligations arise in accordance with the law. According to legal documents on tax administration, currently there is no separate law on tax calculation methods for individuals doing business on social networks, hence this group declares tax similar to other traditional business subjects. According to the Tax Management Law 2019 and related guiding documents, there are 03 tax calculation methods: (1) Declaration method; (2) Method of tax declaration according to each time it is incurred; (3) Presumptive method.

Declaration method

The declaration method is the tax declaration method, calculated according to the ratio of the actual revenue generated by period, month or quarter. Pursuant to the provisions of Clause 5, Article 51 of the Law on Tax Management 2019, stipulates that business entities with a scale of revenue and labor that meet from the highest level in terms of micro-enterprise criteria as prescribed by the law on micro-enterprises. support small and medium enterprises in implementing the accounting and tax payment regime according to the declaration method.

A tax declaration dossier includes a tax declaration form for business individuals, made according to form No.01/CNKD issued together with Circular 04/2021/TT-BTC for tax declaration, and an appendix to the individual's declaration of business activities in the period of business individuals using form No.01-2/BK-HDKD; In case business individuals have grounds to determine revenue as certified by competent authorities, they do not need to submit an appendix to the declaration of business activities. Regarding the place of submission and time limit for submitting a tax declaration dossier, business individuals shall submit a tax declaration dossier at the tax offices directly managing them.

With the self-declaration and self-payment mechanism, the law gives taxpayers the right to self-declare, so that the way individuals who do business on social networks perform depends to a great extent on the taxpayer's consciousness.

Tax calculation method for each time it is incurred

The method of tax declaration according to each time is applied to individuals who do business infrequently and do not have a fixed business location. Individuals doing business on social networks without a fixed business location and doing non-regular business, business individuals earning income from digital information products and services if they do not choose to pay tax according to the declaration method, they will pay tax according to each time it is incurred instead, make tax declaration when there is a taxable revenue.

Business individuals who pay tax on each time shall submit a tax declaration using form No.01/CNKD according to Circular 40/2021/TT-BTC and documents attached to the tax declaration dossier according to the provisions of point a Clause 1 Article 12 of Circular 40/2021/TT-BTC.

A tax declaration dossier will be submitted at the Sub-department of Taxation directly managing where the individual resides (permanently or temporarily residing) within 10 days from the date the individual does business giving rise to a tax liability.

Presumptive method

According to the provisions of Article 51 of the Tax Management Law 2019, the presumptive method is a method of tax calculation according to the percentage of flat revenue determined by the tax authority to calculate the tax rate. Individuals doing business on social networks that are not subject to tax payment according to the declaration method and are not subject to tax payment each time they are incurred will apply the tax calculation method which is the presumptive method. Tax authorities will base on declaration documents of business individuals, tax authorities' databases, and opinions of tax advisory councils in communes, wards and townships to determine the flat tax rate.

Business individuals on social networks paying taxes by the presumptive method will submit a tax declaration dossier including a declaration made according to form No. 01/CNKD according to Circular 40/2021/TT-BTC at the tax department. Regarding the time limit for submitting a tax declaration dossier, from November 20 to December 5 every year, the tax authority shall issue tax declaration form for the following year to flat households and flat households by December 15 of the preceding tax year must submit a tax declaration dossier.

3. Current status of tax management in business activities on social networks

For business activities on social networks, the number of individuals doing business on social networks is increasing rapidly, therefore, it is necessary to determine tax management for this type of business. Accordingly, one of the important and first solutions focused on by the tax administration is to propagate, support and encourage taxpayers to self-register and voluntarily fulfill their obligations as prescribed. Although state agencies have coordinated, retrieved information, and determined the revenue of business entities in this form, tax management for groups of business entities on social networks is still difficult. Specifically:

(i) The seller requires the customer to pay first and deliver the goods later. This is for the purpose of avoiding tax arrears from local tax authorities through delivery and fee-collecting intermediaries such as post offices, etc.

(ii) Many sellers together form their own groups or set up business groups with the same goods for the purpose of sharing orders and selling together to avoid the "snooping" of the tax authorities.

(iii) Sellers use methods such as giving for the purpose of tax avoidance. Some sellers on social networks require that shoppers when transferring payment for goods only need to write "gift, give..." to evade tax.

4. Proposals to strengthen the regulations

In order to effectively manage taxes on business activities on social networks, the tax law needs to be more specific about business activities on social networks. Accordingly, the law should have a specific provision with the name of business activities on social networks. Specific regulations make people aware of doing business on social networks as well as other forms of business, and at the same time create a clear legal corridor for widespread application in society.

In addition, in order to make tax management for business activities on social networks more effective, the State can promote restrictions on the use of cash in transactions. Non-cash payment is an important basis for tax authorities to control cash flow. Buyers are limited to using cash instead, paying through banks, tax authorities can easily retrieve transaction history.

The above is the entire overview of Dai Ha Thanh Law Firm on the provisions of Vietnamese law related to tax management for business on social networks. If you have any questions or concerns, please contact us to receive professional legal advice.