DISSOLUTION PROCEDURES OF FOREIGN-INVESTED ENTERPRISES

Vietnam is becoming one of the countries where globalization is the most vibrant. Such a growing globalized economy is attracting a large number of foreign investors, which plays an important role in the growth of international economic integration, capital, advanced technology, organizational capacity, management, and participation in the global supply chain. According to the General Statistics Office, in 2021, despite the complicated developments of the Covid-19 epidemic, FDI inflows into Vietnam reached 31.15 billion USD, rising by 9.2% compared to the same period in 2020. This shows that foreign investors have great confidence in Vietnam's investment environment. It is undeniable that the majority of foreign-invested enterprises in Vietnam have achieved great results and profits from the Government’s policies and the stable economic and social conditions in Vietnam. However, in that context, there are still several reasons leading to the dissolution of foreign-invested enterprises.

I) Overview on dissolution of foreign-invested enterprises

Current law does not specifically clarify what a “foreign-invested enterprise” is, however according to Clause 22, Article 3 of the Law on Investment 2020, it stipulates that “foreign-invested business organization means an organization whose members or shareholders are foreign investors”.

Pursuant to Clause 1, Article 207 of the Law on Enterprise 2020 and Clause 6, Article 41 of Decree No. 01/2021/ND-CP on business registration, the dissolution of a foreign-invested enterprise is the termination of its existence of a company by the will of the company or by the competent authorities. In other words, the dissolution of an enterprise is understood as the termination of its legal status and related rights and obligations. When the enterprise dissolution procedure is completed, this status will be updated on the National Business Registration Portal.

2) Cases and conditions for dissolution of foreign-invested enterprises

2.1. Cases of dissolution of foreign-invested enterprises

According to the provisions of Article 207 of the Law on Enterprise 2020, enterprises can be dissolved if they fall into one of four cases divided into two groups as follows:

a. Voluntary dissolution

- The operating period specified in the company’s charter expires without an extension decision;

- The enterprise is dissolved under a resolution or decision of the owner for sole proprietorships, the Board of Partners for partnerships, the Board of Members and the owner for limited liability companies, or the General Meeting of Shareholders for joint stock companies.

b. Compulsory dissolution

- The enterprise fails to maintain the adequate number of members prescribed in this Law for 06 consecutive months without converting into another type of business;

- The Enterprise Registration Certificate is revoked unless otherwise prescribed by the Law on Tax administration.

2.2. Conditions for dissolution of foreign-invested enterprise

An enterprise may only be dissolved after fully satisfying the following conditions as provided in Clause 2, Article 207 of the Law on Enterprise 2020:

- All of its debts and liabilities are fully paid

- It is not involved in any dispute at the court or arbitration

3) Procedures for dissolution of foreign-invested enterprises

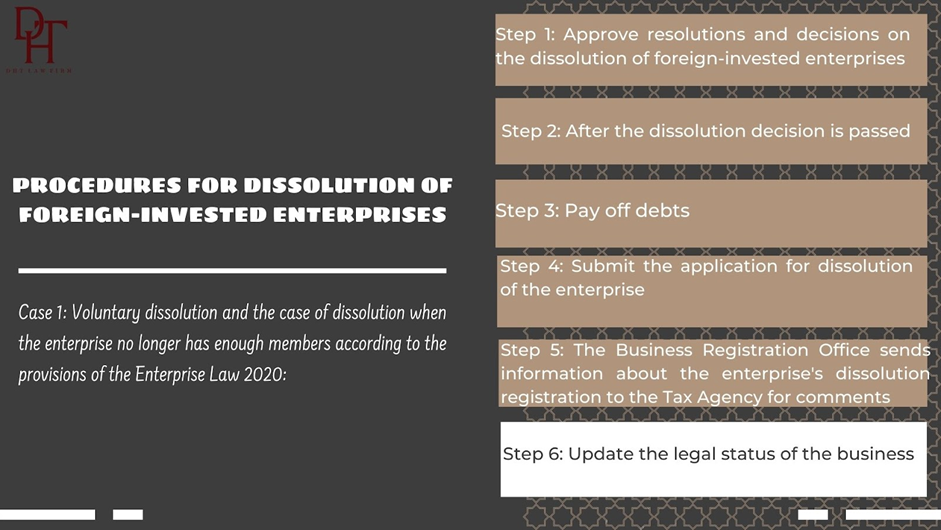

Case 1: For the case of voluntary dissolution and the case of dissolution when the enterprise no longer has enough members according to the provisions of the Enterprise Law 2020:

When an enterprise falls into the above cases, it needs to register for dissolution with a competent state agency according to the following steps:

Step 1: Approve resolutions and decisions on the dissolution of foreign-invested enterprises

In order to proceed with the dissolution of a foreign-invested enterprise, the company must first hold a meeting to approve the dissolution decision. Accordingly, the dissolution must be approved by the owner of a foreign-invested enterprise.

This decision represents the consensus of the members on issues related to the reasons for dissolution; deadlines and procedures for contract liquidation and debt payment; a plan to handle obligations arising from the labor contract and the establishment of a property liquidation team. The decision includes:

- Name and address of the head office of the enterprise;

- Reason for dissolution;

- Time limit and procedures for contract liquidation and payment of debts of the enterprise;

- A plan to handle obligations arising from the labor contract;

- Full name and signature of the legal representative of the enterprise;

- Full name and signature of the owner of the private enterprise, the companyowner, the Chairman of the Members' Council, the Chairman of the Board of Directors.

Step 2: After the dissolution decision is passed

Within 07 days from the adoption of the dissolution decision, the enterprise must:

- Send the resolution, dissolution decision and meeting minutes of the enterprise to the business registration agency, tax agency, and employees in the enterprise.

- Posting resolutions and decisions on dissolution on the National Portal on enterprise registration and publicly listed at the enterprise's head office, branches, and representative offices.

- In case the enterprise has unpaid financial obligations, it must enclose the resolution, dissolution decision, and debt settlement plan to its creditors, persons with related rights, obligations, and interests. The debt settlement plan must have the name and address of the creditor; debt amount, term, place, method of payment of such debt; the method and time limit for settling the creditor's complaint;

Step 3: Pay off debts

In case of enterprise dissolution, the owner of the private enterprise, the Members' Council or the company owner, the Board of Directors shall directly organize the liquidation of assets and liquidation of debts. However, if the company's charter stipulates the establishment of a separate liquidation organization, this organization will organize the liquidation of corporate assets.

The enterprise's debts are paid in the following order of priority:

- Debts in salary, severance allowance, social insurance, health insurance, unemployment insurance as prescribed by law, and other benefits of employees under collective labor agreement and contract signed labor;

- Tax debt;

- Other debts;

Step 4: Submit the application for dissolution of the enterprise

The enterprise's legal representative shall send the enterprise dissolution dossier to the business registration agency within 05 working days from the date of payment of all debts of the enterprise;

- An enterprise dissolution dossier includes the following documents:

- Notice of enterprise dissolution;

- Report on liquidation of corporate assets; the list of creditors and the amount of debt paid, including payment of all tax debts and payment of social insurance, health insurance and unemployment insurance premiums for employees after the decision to dissolve the business occupation (if any).

Step 5: The Business Registration Office sends information about the enterprise's dissolution registration to the Tax Agency for comments

After receiving information from the Business Registration Authority, the tax authority shall send comments on the fulfillment of the tax payment obligation of the enterprise to the Business Registration Office within 2 working days.

Step 6: Update the legal status of the business

After 180 days from the date of receipt of the resolution or decision on dissolution as prescribed, without receiving opinions on the dissolution from the enterprise or the related parties' objections in writing or within 5 working days from the date of receipt of the dissolution dossier, the business registration authority shall update the legal status of the enterprise on the national enterprise registration database;

Note:

- Within 180 days since the Business Registration Office received the notice enclosed with the resolution or decision on dissolution, the enterprise has not submitted the dissolution dossier (and there are no objections from related parties), the Business Registration Office shall issue a notice of dissolution within 3 working days from the end of the above time limit.

- Also within 180 days from the date of receipt of the notice enclosed with the resolution or decision on dissolution, if the enterprise wishes to cancel the dissolution, it shall send a notice of the cancellation of the resolution or dissolution decision to the Business Registration Office (accompanied by the cancellation notice is the cancellation decision of the business owner). Within 3 working days, the Business Registration Office cancels the dissolution, restores the legal status of the enterprise on the National Business Registration Information System and sends cancellation information to the tax authority.

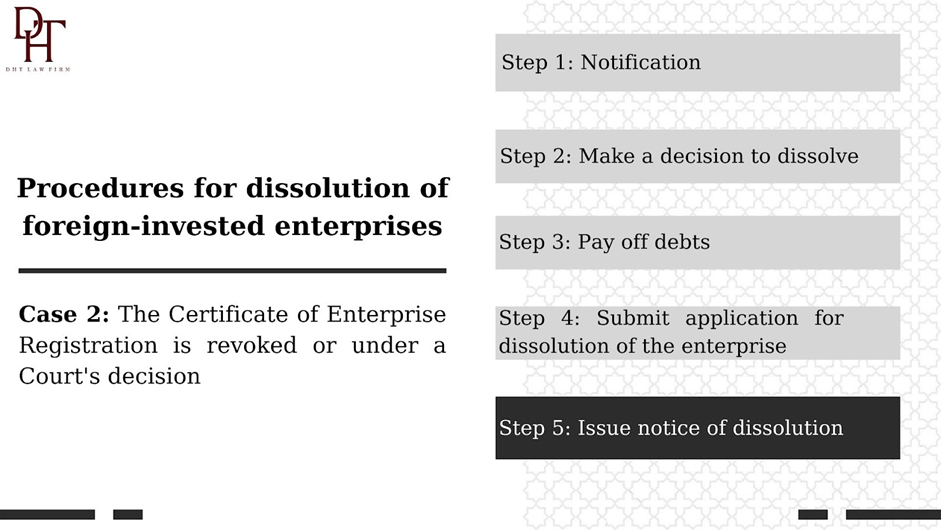

Case 2: The Certificate of Enterprise Registration is revoked or under a Court's decision

Step 1: Notification

The Business Registration Office shall post the decision and notify the status of the enterprise undergoing dissolution procedures on the National Enterprise Registration Portal and send information on the dissolution of the enterprise to the Tax Authority within the time limit. 01 working day from the date of issuing the decision to revoke the Certificate of Enterprise Registration or receiving the legally effective Court decision.

Step 2: Make a decision to dissolve

Within 10 days after receiving the decision on revocation of the Certificate of Enterprise Registration or the legally effective Court decision, the enterprise must convene a meeting to decide on dissolution.

Step 3: Pay off debts

The payment of debts is made in the following order:

- Debts in salary, severance allowance, social insurance, health insurance, unemployment insurance as prescribed by law, and other benefits of employees under the collective labor agreement and labor contract signed act;

- Tax debt;

- Other debts.

Step 4: Submit application for dissolution of the enterprise

Within 5 working days from the date of payment of all debts of the enterprise, the legal representative of the enterprise shall send the enterprise dissolution dossier to the business registration agency.

Step 5: Issue notice of dissolution

After 180 days from the date the Business Registration Office announces the dissolution of the enterprise on the National Business Registration Portal, the Business Registration Office has not received the application for registration of the dissolution of the enterprise and the related party's objections in writing, the Business Registration Office changes the legal status of the enterprise in the National Business Registration Database to the dissolved state, sends information on the dissolution of the enterprise to the tax authority, and at the same time issues a notice of the dissolution of the enterprise within 3 working days from the end of the above-mentioned time limit.

4) Some notes when dissolving FDI enterprises in Vietnam

In general, the procedures for the dissolution of FDI enterprises are similar to those in Vietnam and differ only in the subject matter. So the subject of FDI enterprises only needs to be noted when establishing an enterprise; in addition, there are some specific notes for FDI enterprises when they are dissolved, which are:

- Regarding the termination of an investment project, a foreign-invested enterprise that is granted an Investment Registration Certificate or equivalent document in addition to carrying out the procedures for dissolution of the enterprise, the investor shall notify and return the Investment Registration Certificate to the Investment Registration Authority within 15 days from the date of termination of operation of the investment project, enclosed with a copy of the document recording the termination of operation of the investment project. The investment registration agency shall notify the termination of operation of the investment project to the relevant agencies.

- Enterprises check and close foreign direct investment capital accounts during the dissolution of enterprises.

- After fulfilling financial obligations to the State of Vietnam, in accordance with the law, foreign investors may remit overseas assets that are liquidation of investment projects;

III. Conclusion

Above is the advice of Dai Ha Thanh Law Firm on procedures for the dissolution of foreign-invested enterprises in Vietnam. In case you have any further questions, please contact us to receive professional legal advice.