VALUE ADDED TAX CHANGES IN 2022

Although the Covid 19 pandemic has been temporarily controlled, it has had a serious adverse influence on all aspects of humanity, from life, society to the economy. In particular, Covid 19 has had a negative impact on the production and business, service activities, and cut off supply chains of goods, which has pushed the world economy into a state of recession. Similar to other countries, Vietnam's economy has also suffered heavy losses due to this global pandemic. Therefore, the Government of Vietnam has issued policies to reduce Value Added Tax (VAT) for several services and goods sectors to stimulate consumption demand, and support production and business activities to help businesses and the economy recover soon. Specifically, on January 28, 2022, the Government issued Decree 15/2022/ND-CP on tax exemption and reduction policy under the National Assembly’s Resolution No. 43/2022/QH15 on fiscal and monetary policies supporting socio-economic recovery and development programs.

1. Which fields of goods and services are eligible for Value - Added Tax (VAT) reduction? How much is the Value-Added Tax (VAT) reduction? Effectiveness of Value - Added Tax (VAT) reduction?

According to Article 1 of Decree 15/2022/ND-CP:

"1. Value-added tax reduction for groups of goods and services currently being applied at the tax rate of 10%, except for the following groups of goods and services:

a) Telecommunications, financial activities, banking, securities, insurance, real estate trading, metals and prefabricated metal products, mining products (excluding coal mining), coke, refined petroleum, chemical products. Details are in the Appendix I issued together with this Decree.

b) Products, goods and services subject to excise tax. Details are in Appendix II issued with this Decree.

c) Information technology in accordance with the law on information technology. Details are in Appendix III issued together with this Decree.

d) The value-added tax reduction for each type of goods and services specified in Clause 1 of this Article is uniformly applied at the stages of import, production, processing, business, and trade. For coal sold for sale (including the case of coal mined and then screened, classified according to a closed process, sold) subject to value-added tax reduction. Coal products listed in Appendix I to this Decree are not eligible for value-added tax reduction at stages other than mining and sale.

In case the goods and services mentioned in Appendices I, II and III issued together with this Decree are not subject to value-added tax or subject to 5% value-added tax under the provisions of this Law. Value-added tax shall comply with the provisions of the Law on Value-Added Tax and may not reduce value-added tax.

2. Value-added tax reduction

a) Business establishments that calculate value-added tax by the credit method may apply the value-added tax rate of 8% for goods and services specified in Clause 1 of this Article..."

According to Clause 1, Article 3 of the above decree:

"1. This Decree takes effect from February 1, 2022.

Article 1 of this Decree applies from February 1, 2022, to the end of December 31, 2022.

Article 2 of this Decree applies to the corporate income tax period of 2022."

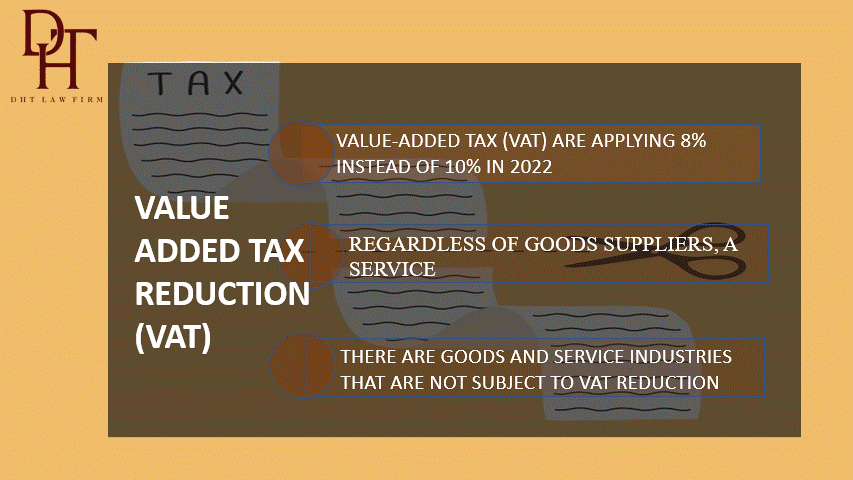

Understandably, the Decree stipulates that the Value-Added Tax (VAT) is reduced by 2% in 2022 for groups of goods and services that are applying the 10% tax rate, regardless of goods suppliers, a service is an enterprise, organization, or business household or individual.

However, not all sectors of goods and services are entitled to the tax reduction of 2% according to the above Decree, in which there are goods and service industries that are not subject to VAT reduction:

- Telecommunications;

- Information technology under the law on information technology;

- Financial activities;

- Bank;

- Securities;

- Insurance;

- Real estate business;

- Prefabricated metal and metal products;

- Mining products (excluding coal mining);

- Coke;

- Refined petroleum;

- Chemical products;

- Products and services subject to excise tax.

This Decree takes effect from February 1, 2022, to the end of December 31, 2022.

2. How is the Value-Added Tax (VAT) reduction procedure done?

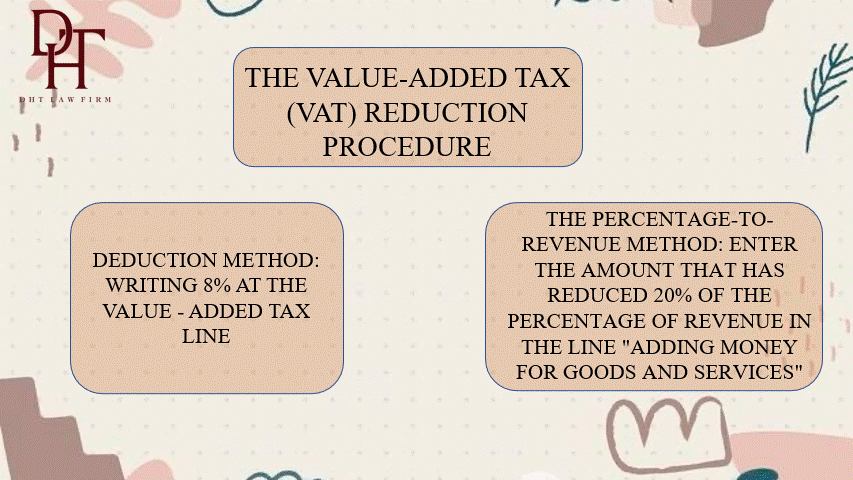

Depending on the method of calculating Value - Added Tax (VAT), business establishments will carry out different procedures for reducing Value - Added Tax (VAT), specifically as follows:

|

Deduction method |

The percentage-to-revenue method |

|

When making a Value-Added Tax (VAT) invoice, write 8% at the Value-Added Tax line. Based on the value-added invoice: - Business establishments selling goods and services declare output Value - Added Tax (VAT). - Business establishments that purchase goods and services shall declare and deduct input Value - Added Tax (VAT) according to the reduced tax amount indicated on the invoice. |

Fill in the money for goods and services before reducing in the column "to money". - Enter the amount that has reduced 20% of the percentage of revenue in the line "Adding money for goods and services". - Note: "Reduced ... (amount) corresponds to 20% of the percentage rate to calculate Value - Added Tax (VAT). |

3. Problems and solutions related to tax reduction

- How to handle when issuing 10% invoice for goods with tax reduction to 8%

According to Clauses 5, 6 of Article 1 of Decree 15/2022/ND-CP:

"5. In case the business establishment has issued an invoice and declared at the tax rate or percentage for calculating the value-added tax that has not been reduced as prescribed in this Decree, the seller, and the buyer must make a record or have a written agreement clearly stating the error, at the same time the seller makes an invoice to correct the error and delivers the adjusted invoice to the buyer. Based on the adjusted invoice, the seller declares the adjustment. output tax, the buyer declares and adjusts input tax (if any).

6. In case a goods or service business establishment eligible for value-added tax reduction has issued an ordered invoice printed in the form of a ticket with a pre-printed face value that has not been used up (if any) and needs to: If the business needs to continue using it, the business establishment shall stamp it according to the price that has been reduced by 2% of the value-added tax rate or the price that has been reduced by 20% at the percentage rate next to the pre-printed price criterion for continued use. "

In case a goods or service business is eligible for a VAT reduction from 10% to 8% but invoiced at the unreduced tax rate, the business establishment will have to take the following actions:

1. Make a record or agreement specifying errors related to tax reduction.

2. Invoice for correction of errors and deliver the invoice for correction of errors to the buyer.

3. Based on the adjusted invoice, the seller declares and adjusts the output tax, and reports the input tax adjustment (if any).

In the case where a goods or service business is eligible for VAT reduction, it has issued an ordered invoice printed in the form of a pre-printed ticket with its news face value (if any) and needs to use it. To continue, the business implements the stamp according to the price adjusted by 2% VAT or 20% reduction in percentage next to pre-printed price criteria:

Above is the advice of Dai Ha Thanh Law Firm on the policy of reducing value-added tax (VAT) to 8% for some goods and services. If you have any questions or issues, please contact us to receive professional legal advice.